Like Spain, Italy's cement market collapsed dramatically after the global financial crisis, with cement consumption falling to just 18Mt in 2016 from the 2006 peak of 47Mt. Since then, overcapacity and a fragmented industry have seen profitability vanish while efforts to deeply restructure the industry have been too slow. Recent deals, however, suggest the end may be in sight.

From 2006 to 2016, the Italian cement sector embarked on a major phase of capacity reduction, closing 29 cement plants, 26 kilns and over 10Mta capacity. However, with demand shrinking even faster, overcapacity remained a big problem with prices falling to the lowest level in Europe to the current level of EUR52/t.

The solution for the industry is to consolidate ownership, balance supply and demand, and increase prices to a level that can restore profitability. However, this rationalisation process has been held back due to the fragmented structure of the industry, with over 20 players and a high number of small, family-owned cement plants.

These small independents have been unwilling to sell, clinging on to the hope that once the market recovers or the bigger players merge, prices will recover and they will return to profitable operation. This deadlock was not worth the trouble for Cementir, Italy’s fourth-largest player, who had already attempted to accelerate consolidation of the industry with the acquisition of Sacci in 2016. Instead Cementir made a clear decision last month to exit the Italian cement industry altogether, announcing that it had agreed to sell its Italian assets under its Cementir Italia subsidiary to Italcementi (HeidelbergCement) for an enterprise value of EUR315m, subject to approval by the Italian Antitrust Authority expected in early 2018.

Cementir Italia's portfolio comprises five integrated plants and two cement grinding centres with a capacity of 6.3Mta as well as a network of seven terminals and 45 concrete plants. As a standalone entity, Cementir Italia's share of the market was approximately 13 per cent, while market leader Italcementi holds 24 per cent.

HeidelbergCement will gain improved nationwide footprint from the acquisition, whilst using its dominant position to bring about badly-needed consolidation. HeidelbergCement expects the extract annual synergies of EUR25m by 2020 but will offset the acquisition through the sale of other non-core assets in its portfolio. In Italy the company may yet decide to recycle some of the assets to other players, close redundant capacity, or be forced to by the Italian Antitrust Authority.

Italcementi Italia, which became part of the HeidelbergCement Group (Germany) in 2016, owns 15 grey cement plants across Italy with 12.25Mta capacity. Combined with Cementir’s assets (2.465Mta sales in 2016), the company could expand capacity to 18.55Mta – 34 per cent of domestic capacity.

Overall, this would place 68 per cent of capacity in the hands of the three main players, Italcementi (34 per cent), Buzzi Unicem (21 per cent) and Colacem (13 per cent).

Rebalancing the market

Provided Italcementi's acquisition is approved by the regulator, it is likely that the overlapping assets will be closed.

Italcementi is likely to close or sell Cementir's northern Italian assets of Arquata Scrivia and Tavernola as they overlap existing quality assets, including the renovated Rezzato plant.

In the centre of the Italy, where oversupply and low pricing has plagued the industry, Italcementi gains a strong footprint with four new plants (Greve, Castelraimundo, Spoleto and Cagnano) and may close one to balance with market demand.

In the south, around Naples, Salerno is likely to continue its grinding operations, supplied by clinker from Colleferro, while Maddaloni is understood to only have 1.5 years remaining quarry life, after which it may be closed.

Finally, further south, overlap between Italcementi's modern Matera plant and Castroviallari grinding plant will remain making Cementir's Taranto grinding works redundant. In a further complication to the deal, Taranto was ordered to stop production on 28 September following accusations that it is using contaminated fly ash from the adjacent Lecce/ Enel power plant. It is not clear how this could affect the Cementir deal.

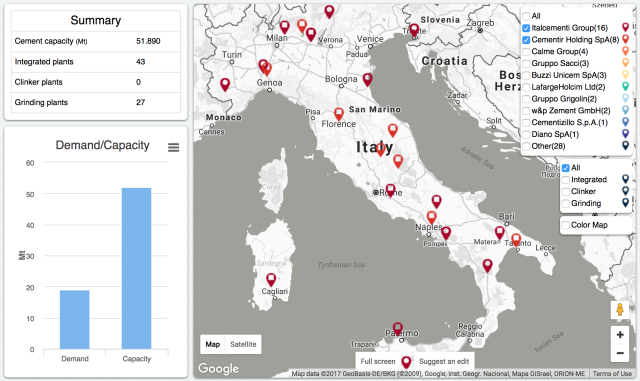

Cementir and Italcementi's combined cement plants in Italy

Source: The Global Cement Report, 12th Edition, 2017

What next?

This year cement demand in Italy is expected to rise – for the first time since the crisis – by 0.6 per cent in 2017, according to the latest forecast by the Italian cement association, AITEC. In the long term, AITEC expects cement demand to stabilise at around 23-25Mta. Clearly, given industry capacity at over 50Mta, further consolidation by the main players will be required to restore a sustainable equilibrium.

If momentum does stall, then the next hurdle will be 2020, when the next phase of the EU Emissions Trading System will come into force. Smaller players may find the lower allocations a burden too far, and elect to sell rather than continue in such a dysfunctional market.

Meanwhile, Cementir is assessing its own company strategy and must decide if it wishes to recycle proceeds of the sale back into its global cement portfolio, or exit the sector altogether. At the recent Cemtech Rome conference in Rome earlier this month, Paolo Bossi, CEO of Cementir Italia, argued that in future Cementir would likely focus on the white cement sector, in which it has a leading market share worldwide.