Last week, CRH made an announcement that it was creating a new global Building Products division which would start operation in January 2019 by merging its European Distribution and Americas Products divisions. Due to the company's enlarged scale, it sees opportunities for further value creation for its shareholders and is looking to maximise its network to improve its global products business. This comes after several years of re-positioning itself post-financial crisis when several of the Irish company's assets were divested.

The Irish Times has reported on how the company's CEO, Albert Manifold, was tasked with the job of selling off parts of the portfolio such as the minority stake in Nesher Cement in Israel and a 50 per cent stake in a Turkish ready-mix concrete business along with Allied Building Products in the USA. "We forgot the core principle of CRH, which is that we used to make business better," said Mr Manifold at the time. "We invested in bubbles."

European distribution division sale?

However, reports by the building materials giant of a strategic business review of its European Distribution unit had analysts pointing towards further disposals of assets from the unit, which sells building materials for plumbing contractors and DIY customers. The unit accounted for 16 per cent of the group's EUR27.6bn sales in 2017 yet generated, at EUR269m, only nine per cent of group EBITDA. This would mirror the path that CRH has taken in the USA by selling its distribution business there.

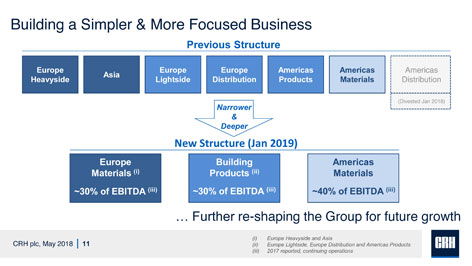

By reviewing or even divesting its distribution network and forming a building products division, CRH would become more cyclically exposed, according to some analysts. The Building Products Units would account for approximately 30 per cent of EBITDA as would European Materials (including Asia), while Americas Materials division would account for 40 per cent of the company’s EBITDA going forward.

New CRH Corproate structure from January 2019

Reliance on Heavyside grows

Recent acquisitions of LafargeHolcim assets and Ashgrove Cement (US$3.5bn) have certainly re-focussed attention on the cement sector for the company. Ash Grove Cement's integration will be the next stage in CRH's to do list and it has already issued US$1.5bn of bond debt last Spring to help finance the purchase. The company has also acquired some 27 ready-mix cement batching plants from Breedon Group in the UK.

Deutsche Bank analysts Glynis Johnson has estimated that the group currently generates more than 70 per cent of its earnings from the heavyside (aggregates, cement, lime, ready-mix and asphalt) of its portfolio and these products in Europe are evenly split over the end markets of residential, non-residential and infrastructure.

It is the cement business that has seen strong growth, and the company now has a total cement capacity of 27.1Mta in Europe. The Americas offers a further 6.8Mta cement capacity with much more reliance on infrastructure as an end market, accounting for 55 per cent of the company’s exposure in this market.

Analysts and market response

However, some analysts are less confident that CRH is making the right moves to bring value to the company. City broker Numis has recently downgraded CRH Plc to 'hold' from 'add' with CRH attempting to target 300 base points EBITDA growth by 2021. "We believe that the remaining margin growth will be achieved through the divestment of lower margin businesses, such as European Distribution," the analysts concluded.

Nevertheless, the markets have responded positively to the new global Building Products division announcement with CRH shares rising by four per cent at the start of June. Investors are cheered by the company's four-year plan to spend approximately EUR7bn on further acquisitions.