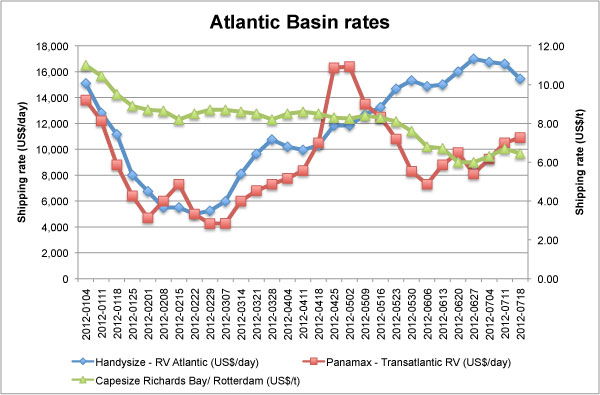

With summer activity on the low side, shipping rates generally softened for Handysize, Panamax and Capes, both in the Atlantic and Pacific basins. With a more or less inactive Atlantic market, prices for charters were significantly more affected in the western hemisphere, noting rate decrease of up to a third. The Pacific held up better with declines ranging in the 6-16 per cent bracket.

In the Handysize segment RV Atlantic charter rates fell by a quarter to US$11,500/day over the fortnight ended 1 August, while their Pacific counterparts lost ground too, albeit by a more modest 14 per cent to US$7750/day. The TCT Cont/Far East contract limited its slide to six per cent, ending at US$21,500/day.

A similar story unfolded in the Panamax market where transatlantic RV prices dropped by nearly a third to US$7400/day and TCT Far East RV rates fell 16 per cent to US$7300/day over the same period. With talk of a rail strike in Colombia, business out of South America and the US Gulf is reported to be limited.

Capesizes appeared to be holding their rates better although they were also affected by the quiet period. TCT Cont/Far East shaved 7.3 per cent off its price to US$21,500 while Richards Bay/Rotterdam saw a similar decrease to US$6.00/t. Fearnleys note an absence of fresh enquiries. “It may seem that players’ focus is presently more on London 2012 than on minerals trading,” says the broker.

The Baltic Dry Index continued its downward trend from 1074 on 18 July to 982 one week later. On 1 August, Bloomberg registered it on 878.