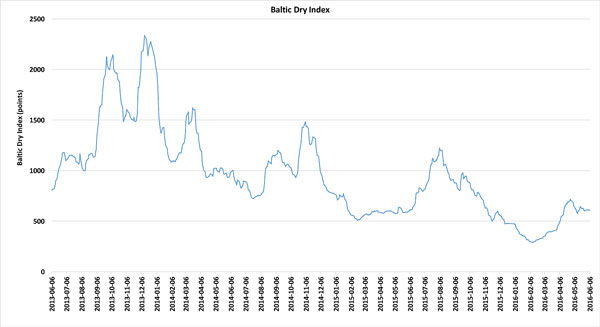

Despite bouncing back from the historic lows seen in February 2016 (290 points on 10-11 February), the Baltic Dry Index (BDI) continues to experience downward trends, as seen in the three-year trend shown in Figure 1.

Figure 1: Baltic Dry Index, 6 June 2013-6 June 2016

Under these challenging conditions, some ship owners have resorted to chartering their vessels for less than one third of their operating expenditure (not including financing). This downward pressure since end 2013 has led to consistent losses for many companies in the sector, and at times even bankruptcies. In 2015 Greece-based DryShips Inc sold off a large section of its fleet (13 Capesize and 4 Panamax bulk carriers) and classified all remaining vessels as held for sale.

Until recently there had been speculation of an early recovery on the horizon for dry bulk shipping, but current forecasts now do not estimate any significant recovery for the next few years, with TradeWinds suggesting "no meaningful dry bulk recovery before 2019", in light of a recent report from Deutsche Bank. Amit Mehrotra, Deutsche Bank’s shipping analyst, noted that despite the fact that “scrapping reached an all-time high in the first quarter of 2016”, total capacity is still up by 0.4 per cent (30 ships) since January 2016 as a result of 175 new-build deliveries.

In this light, Chief Shipping Analyst at Baltic and International Maritime Council (BIMCO), Peter Sand, commented on last month’s temporary surge in the BDI in an interview on 2 May 2016, saying, “Overcapacity is serious. The current lift in freight rates is not a result of evaporated overcapacity. The prospects for the dry bulk market is one that spells out a multi-year recovery."