Titan Group released its 9M17 results this week and was hit by two exceptional events, namely hurricane Irma and the currency devaluation in Egypt. While the group's turnover reached EUR114.5m, a 1.8 per cent increase on the same period in 2016, 3Q17 turnover declined by 7.4 per cent to EUR370.7m and EBITDA fell by 15.3 per cent to EUR72.4m.

USA bolsters results

In the USA, where the company operates 3.5Mta cement capacity, the company reported that the market continues to grow despite the short-term challenges posed by the effects of hurricane Irma which struck the state of Florida in September 2017. "The favourable trend in demand allowed for an improvement in both selling prices and margins," said Titan.

Turnover and EBITDA in the third quarter were flat versus 2016, despite the weather disruptions which, it is estimated, resulted in US$8m reduction at the EBITDA line.

Titan is more optimistic about its US operations going forward. "The growth in demand, in conjunction with the benefits accrued from the extensive capital spending programme in recent years, allow for an optimistic outlook on performance," Titan added.

Egyptian market suffers

Meanwhile, the Egyptian market had a more negative impact on the group’s 3Q17 results after the devaluation of the Egyptian pound in 2016.

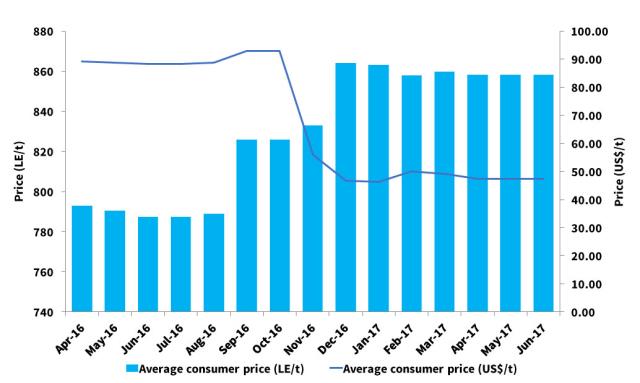

The devaluation of the Egyptian pound against the US$ has led to a large loss in earnings for companies like Titan

Egyptian cement consumption fell by 22.8 per cent in January 2017 YoY to 4.326Mt. Consumption fell less steeply over the summer, but YoY consumption growth was still down 7.2 per cent in June 2017 and Titan’s latest results reflect the continued downturn.

"Demand for building materials in 2017 is estimated at about eight per cent below the previous year’s levels,” reports Titan. “Prices increased in local currency but still recorded a considerable decline in Euro-terms and, at present, cannot compensate for the increase in costs.

"Furthermore, the implementation of a staff reduction restructuring programme in 3Q17 adversely impacted EBITDA by EUR6.3m."

There are deep-rooted challenges with the Egyptian market where more new capacity has been lined up, while the currency devaluation has forced producers raise cement prices to protect margins. "The Egyptian market is still absorbing the impact of the large currency devaluation and the imbalance between the surplus supply and the depressed demand. The already existing imbalance will be further exacerbated by the entry into operation of additional new capacity in the coming months," says Titan.

Having completed the investments for the utilisation of solid fuels at its plants and after effecting a significant reduction in headcount, the group has strengthened its competitive position and ensured fuel sufficiency. In the immediate future, concerted efforts will continue towards attaining a further reduction in costs, increasing alternative fuel usage and increasing prices.

Total turnover in the Eastern Mediterranean region for the nine months of 2017 declined by 39 per cent, reaching EUR114.3m while EBITDA declined by 66 per cent to EUR11.1m.

Exports to rise from Greek operations

In Greece, Titan's home market, demand is anticipated to be markedly below that of 2016. Following the completion of the major highway projects, new infrastructure projects are still in the planning phase with no clear start date. Private building activity remains at very low levels, despite certain new projects in the tourism industry.

However, cement production in Greece will continue to be channelled away from the domestic market towards export destinations in 2017. Titan's coastal production facilities are well-suited to serve the export market, sending volumes to destinations in the Mediterranean and West Africa, in particular.