|

Prices at a glance |

|

| Crude oil - bbl | US$64.00 |

| Coal API 4 - 1Q18 | US$91.25 |

| Coal API 4 - Cal2018 | US$88.00 |

| Petcoke | |

| USGC 4.5% 40HGI FOB | US$82.00 |

| USGC 4.5% 40HGI cf ARA | US$100.50 |

| USGC 6.5% 40HGI FOB | US$72.50 |

| USGC 6.5% 40HGI cf ARA | US$91.00 |

In November the US dollar was supported by the US tax reform, which could see US firms repatriating profits. The lack of German government formation kept the euro on a weaker footing, consolidating between US$1.16-1.20. The continued deterioration of the situation in North Korean has further supported the US$. Forecast: medium-term range US$1.16-1.20.

Crude oil

OPEC decided to prolong the production cuts until end-2018, with an evaluation meeting in June 2018. This came as no surprise to the oil market, with prices rising to US$63. Saudi Arabia’s mention of a preferred price around US$60 confirmed the recent level of US$58-64. A higher price would add more US shale production, which OPEC is trying to avoid, finding the “Goldilocks level” instead. US WTI oil now has a US$5 spread to Brent, due to forward hedging from US producers. Resistance is at US$64 with a major level at US$67. Support is found at US$61 and major at US$58. Stochastic is neutral.

Coal

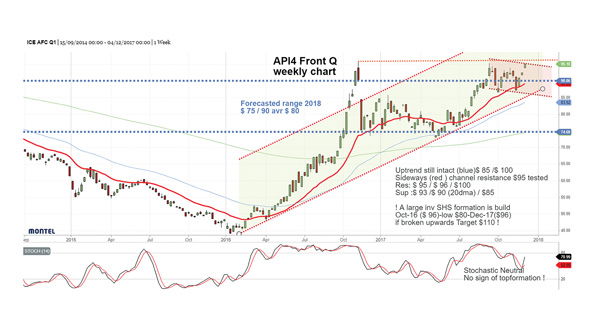

At the Cemprospects-17 conference the trading range of the front-quarter (FQ) price in 2018 was forecast at US$75-90 with an average of US$80. Cemreview was wrong in its call for a pullback in prices in November. While measures from the Chinese NDRC did indeed lower the Chinese domestic price with 10 per cent, strikes in Australia, weather conditions in Indonesia and loading issues in South Africa kept the market tight and the rally in API 2 and API 4 continued, reaching major resistance levels. Cemreview maintains its forecasts for 2018 average.

Some relief has been brought to the markets with the ending of the strikes in Australia and the avoidance of a potential one in South Africa. However, two bullish factors are still supporting the markets. Winter forecasts are cold for both China and Europe. French nuclear power production is also lower than expected and low hydro reserves in Spain in particular are raising demand. A possible petcoke ban in India has created a surge in coal demand from domestic cement producers and power companies. The final outcome is due in December.

The API4 is consolidating at US$90/US$95 but will likely stay high during December-January. Resistance at US$96 and major at US$100. Support is found at US$90 and major at US$85. For the API4 front-year (FY) resistance is seen at US$92 and support at US$85. The stochastic indicator is “neutral”. Forecast: FQ – US$90-96, FY – US$86-92.

Figure 1: API 4 front-quarter commodity prices by week

Petcoke

At Cemprospects-17 the trading range for USGC 6.5 per cent sulphur FOB was estimated between US$57-75 with a 2018 average of US$65.

The impact from Hurricane Harvey, which created price spikes, was fully overshadowed by surprising news from India’s Supreme Court banning the use of petcoke in the capital and three neighbouring states. Furthermore, Gujarat introduced a ban of >7 per cent sulphur petcoke. The Supreme Court indicated that a potentially-nationwide or an import ban would still allow domestic petcoke to be used as feedstock on refineries for gasification. Either ban would severely impact the market with more than 12Mt of petcoke in import. The market reacted with prices for the 6.5 per cent sulphur type falling sharply from US$70 to US$60 and even lower offers. However, a new hearing is to take place 11-13 December, indicating the Court’s further review of a cement sector exemption.

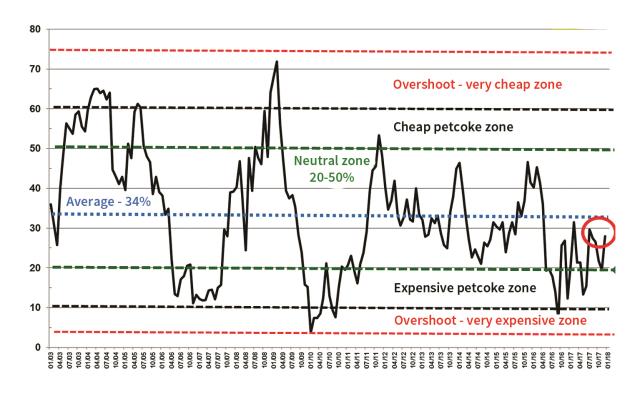

The discount for FOB USGC 6.5 per cent 40HGI to API4 coal rose to 48 per cent, which is seen as the top range for the neutral price zone. Due to rising freight rates from USGC to ARA currently seen at US$20, the ARA CFR discount of petcoke to ARA coal rose from 20 to 28 per cent, remaining below the long-term average.

Figure 2: petcoke discount to coal (API 2 USGC6.5% cfr ARA 6000kcal base) – Dec 2017: 28%

The spread from 6.5 and 4.5 per cent petcoke also widened from US$10 to almost US$20 as the latter is not widely used in India. The spread is expected to decrease towards an average US$12-15, as the 4.5 per cent is dragged lower.

Cemreview estimates the price for FOB USGC 6.5 per cent to be volatile in a range of US$55-65 and the freight rate of ARA to be around US$20. Direction for the coming months will be set by the outcome in India.

This energy market review is authored by Frank Branvoll, Editor of cemreview, published by Cimeurope SARL (cimeurope@cimeurope.eu) and was first published in International Cement Review, January 2017.