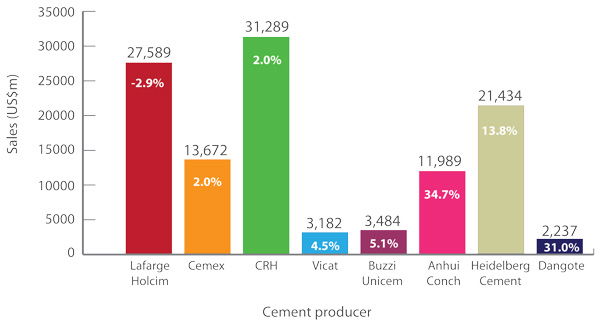

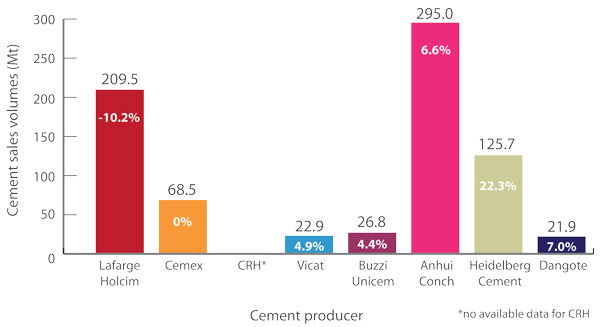

On the whole, 2017 was a year of growth for the world's leading cement producers. HeidelbergCement saw its revenues advance by 13.8 per cent YoY, while China's Anhui Conch reported sales growth of 34.7 per cent. Dangote recorded an improvement in revenue of 31 per cent while Cemex, Buzzi Unicem, Vicat and CRH all saw more marginal expansions of between two and 5.1 per cent YoY (see Figure 1). The only major to report a fall in sales revenue was LafargeHolcim, dipping 2.9 per cent as its cement volumes contracted by 10.2 per cent YoY to 209.5Mt (see Figure 2).

Figure 1: major producer sales (US$m) and YoY change (%), 2017

Figure 2: major producer cement sales volumes (Mt) and YoY change (%), 2017

USA: a top market for many cement producers

Much of the growth seen by the leading players was driven by a strong US market and the ongoing recovery in Europe. HeidelbergCement’s US volumes improved by 22.3 per cent YoY to 125.7Mt on the back of robust commercial and residential construction, despite bad weather in the opening quarter of last year. Sales volumes in Canada also fared well due to a recovery in oil-related projects. Vicat and CRH benefitted from the US uptick with regional sales advancing by 10.3 and four per cent, respectively. Cemex, meanwhile, saw its US cement volumes contract by six per cent as weather events dampened demand in Florida.

Latin America: a mixed bag

Latin America continued to be a mixed bag. Brazil was persistently challenging for the likes of LafargeHolcim, although the company did report record earnings in Argentina. Cemex saw its Mexican cement sales improve, up by eight per cent YoY, with prices advancing by 16 per cent. Colombian prices, however, slipped by up to 13 per cent due to weak demand.

Europe: construction growth

For Buzzi Unicem, whose volumes increased last year by 4.4 per cent YoY to 26.8Mt, Europe was its high point of 2017. The company noted a significant strengthening of the construction sector in Germany, particularly in the residential and public infrastructure markets. There was also lively construction activity in Norway, an uptick in demand in Sweden and Romania, and positive signs of a recovery in Italy, Spain and France. The UK, however, saw sales volumes decline for HeidelbergCement due to political uncertainty and Brexit delaying infrastructure programmes.

India and south Asia: price changes

A favourable economy drove demand in India for the likes of Vicat, which reported 13 per cent sales volume growth there and a small increase in prices. UltraTech, India's leading cement producer, recorded a 33 per cent YoY rise in sales in the final three months of the year, along with a 37 per cent improvement in volumes. For HeidelbergCement demonetisation and tax reforms kept volumes down for its Indian operations. However, the company did note an increase in domestic consumption in Indonesia but a fall in Thailand. The region was a mixed bag for LafargeHolcim too, which enjoyed strong demand in India, China and Australia but ongoing pricing pressure in Malaysia and the Philippines.

China: rising raw material costs

For CRH, lower construction activity in China impacted its volumes there, but this was offset by stronger pricing. Continued supply-side reform is helping to improve the business environment in China, according to Anhui Conch, whose cement and clinker sales improved by 6.6 per cent YoY to 295Mt in 2017. However, the rising cost of coal, electricity and raw materials continues to plague producers.

Africa: subdued cement demand

The African market was dominated by falling demand in Nigeria, where Dangote saw its cement volumes decline by 15.9 per cent YoY as consumer spending tightened, despite the country coming out of recession in the 2Q17. South Africa's economy also remained subdued, leading to muted activity in the domestic cement market. Elsewhere, Cameroon performed well with cement consumption driven by housing and infrastructure projects, while Ethiopia saw its construction sector boom, fuelled by the housing market with 2.4m homes due to be built in 2015-20.

Outlook

For 2018, all the majors are expecting an ongoing recovery in the US market, further stimulated by the recent tax reforms. Europe is forecast to continue its recovery, apart from the UK where political uncertainty will keep demand under par. Infrastructure spending should drive demand in India, while strong GDP growth and new housing projects are forecast to bolster the African markets. Higher energy and raw materials prices are an ongoing challenge. Despite this, LafargeHolcim is targeting annual sales growth of 3.5 per cent for the next five years.