Brazil's cement market has seen a dramatic change in recent years with growth leading to a record production of 72.5Mt in 2014. However, this was followed by the country's biggest economic slump that has since been compounded by the outbreak of the COVID-19 pandemic. With corruption in the construction sector, currency devaluation and a drop in cement demand, Brazil's cement sector has had to revitalise itself. Flávio Guimaräes, economist at Brazil's cement association, Sindicato Nacional da Indústria do Cimento (SNIC), was able to inform Cemtech webinar viewers this week that the industry is fighting back and is on course for a strong recovery.

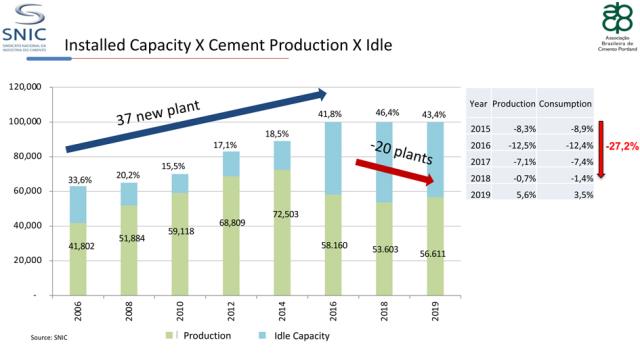

Mr Guimaräes outlined that Brazil remains one of the leading cement-producing countries of the world with 23 industrial groups producing cement in a sector with 100 plants, of which 62 are integrated plants and 38 are grinding units. The plants are distributed across 88 cities and 24 states with a total cement capacity of 100Mta and an output of 56.6Mta in 2019.

However, this strong industrial base has been under pressure as cement demand has contracted. Domestic cement consumption was estimated at 54.8Mt last year, down from 72.7Mt in 2014. This has led to 20 cement plants to temporary close since the peak year of 2014. Moreover, this year cement producers have seen their capacity utilisation impacted by the coronovirus.

Market evolution

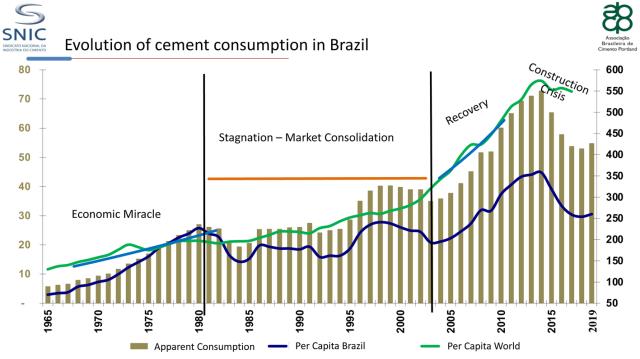

Brazil’s cement market evolution has been rapid. The period from 1965-1980 has been referred to as the 'economic miracle' when cement production rose sharply from 6Mt to 27Mt. This was followed by a period of stagnation and market consolidation between 1980-2004, which saw the entry of foreign cement producers with demand rising to 40Mt. The 'recovery period' spans the years from 2004-14 when cement consumption peaked. In these years 37 greenfield plants were built in the country. The construction crisis followed, leading to a 24 per cent fall in cement demand, plant closures and 46.4 per cent idle capacity in the sector. Cement demand started to recover again in 2019, growing by 3.5 per cent YoY.

Evolution of Brazilian cement consumption, 1965-2019

Installed cement capacity, cement production and idle capacity, 2006-19

2020 developments

SNIC had forecast growth of two per cent for the domestic cement industry in 2020 before the pandemic hit, said Mr Guimaräes. Heavy rains in January and February 2020 had already pegged back the expected demand before COVID-19 saw state restrictions and temporary paralysis for the industry with a 20 per cent drop in construction sector activity.

Mr Guimaräes stated that cement sales fell seven per cent in April 2020 compared to a year earlier. The government prevented the impact from being more severe by recognising the cement and construction sectors as essential contributors to the economy. The surprise was that rather than seeing cement sales decline, they started to rise in May by double-digits. People were working on maintenance projects and renovations to their homes. The self-construction consumer was lifting cement demand. Demand was also helped by commercial and residential building restarting with safety protocols in place. This led to a 17.3 per cent sales growth between May and October 2020.

By August the construction sector had recovered from stoppages. But there had been a change in what was driving cement demand. In 2011 residential building accounted for 58.6 per cent of cement demand, infrastructure 24.9 per cent, and commercial/industrial and services building for 16.5 per cent. In 2020, 90 per cent of demand has come from residential and just 10 per cent from infrastructure projects. This has enabled accumulated cement sales to grow by 9.2 per cent between October 2019-September 2020 to reach 58.412Mt, reported Mr Guimaräes.

The industry has also renewed its regulations on clinker factor for cements, lowering it to enable more clinker substitution. In October 2020 the government also released a new authorisation to burn alternative fuels in cement kilns. Brazil's cement technology roadmap was also launched in 2019, showing the challenges that the cement sector has in sustainability and what action can be taken to increase alternative fuels and change standards to increase additional replacement products for clinker. "This is an agenda the Brazilian cement industry is very activated in promoting," said Mr Guimaräes.

2021 outlook

The situation today is that COVID-19 cases in Brazil have been decreasing and the economy is reopening. However, much uncertainty remains. It is not certain that residential demand for cement will be sustained and there’s a shortage of new infrastructure projects being announced, said Mr Guimaräes.

The main concern is whether the infrastructure projects will resume. "We have many things to do in infrastructure," said Mr Guimaräes, "We have roads to construct, ports and airports to build and if they [the government] start to do this investment we have a good chance to have strong growth like we had in 2004-14, when housing was the main driver for deamand."

The emergency income from the government is expected to be reduced and that will also hit cement demand. Unemployment is expected to rise and together with a loss of savings, "the self-construction segment will have a lower propensity for cement consumption," said Mr Guimaräes. "Added to this, there is also a risk of inflation."

The government's fiscal programme is also stretched with enormous amounts spent on alleviating the impact of COVID-19 which has increased the country's debt.

The positives can be seen in the introduction last year of a new sanitation regulatory framework and the Casa Verde Amarela housing project, vectors that could see cement volumes reach 60Mt in 2021. The water sanitisation and waste systems demand private investment which should be a good programme for cement demand in 2021, added Mr Guimaräes.

Brazil still has its difficulties. The corruption in the construction industry may not have been completely rooted out and many of the temporary kiln closures remain in place, although some of these plants have restarted. While there is unlikely to be much large-scale investment into greenfield plants in the near term, there will be continued investment into areas such as alternative fuels, optimisation projects and initiatives targeting improved sustainability of the industry.

Cemtech's next Live Webinar on 'Conventional kiln fuels - preparation, storage, firing and safety' is being held on Wednesday 11 November 2020 at 8.30am (UK Time). For more information and free registration visit the Webinar registartion page.