By Frank O. Brannvoll, Brannvoll ApS, Denmark

Leading central banks raised rates again by 0.75 per cent, with promises of more to come as inflation is persistent as sanctions are still keeping energy prices artificially high in Europe. The EU has not agreed on any common measures as these are very hard to introduce in a free market. However, the threat of demand destruction combined with a warm start to the winter has put pressure on the overall energy complex.

Gas prices have been falling as reservoirs are full in EU and coal stocks are at record levels. The intensive buying has stopped and markets are calming down, at least until the winter cold may be back.

The war in Ukraine is in a new phase and this, combined with the upcoming winter, could perhaps have the two sides discuss a peace agreement without outside interference.

The US dollar has fallen back to parity 1.000 with the euro as the European Central Bank is now keeping up with the interest rate hikes. For 2023 Branvoll ApS expects a range of US$0.90-1.10 with an average of US$1.02.

|

Prices at a glance |

|

| Crude oil - bbl | US$98.00 |

| Coal API2 - 4Q22 | US$200.00 |

| - Cal2023 | US$195.00 |

| Coal API4 - 4Q22 | US$205.00 |

| - Cal2023 | US$199.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$152.00 |

| CFR ARA |

US$175.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$142.00 |

| CFR ARA | US$165.00 |

Oil and gas

Oil rose after the OPEC+ agreement to cut 2mbpd, stabilising between US$90-100/bbl as China is keeping its COVID-19 policy with risk of closures. Overall demand may still be falling as interest rates starts to bite, but oil is now also being used for power generation, supporting oil prices.

The next OPEC meeting is on 4 December. The following day, the G7 will introduce a price cap for Russian oil, which is expected to be extremely hard to implement and control.

The short-term range for Brent is expected to be US$92-100/bbl. For 2023 Brannvoll ApS expects a range of US$80-115/bbl, with an average of US$98/bbl.

Coal

Coal has fallen sharply in both API2 and API4, reflecting lower demand. Russian discounts are also finding their way through the markets. However, Russian coal exports are up 22 per cent YoY in 2022. The eight-fold rise in Russian coal exports to Turkey shows the huge discounts given to countries outside the sanction area. In Turkey’s case, the country’s government is considering the longer-term purchase of Russian coal.

The stocks in ARA are at a record high while in China coal production has been increased, lowering import demand. This has also pushed the coal price downwards. The clean dark spread remains at EUR250 and as a result, there is a high demand for coal used in power generation. The price has now shifted to the 1Q23.

The API2 front-quarter (1Q23) contract fell again by 21 per cent MoM to US$200. For 2023 Brannvoll ApS expects a range of US$200-300 with an average of US$225. The API2 Cal23 contract fell 17 per cent MoM at US$195. In 2023 a range of US$200-300 is expected, with an average of US$250.

The API4 front-quarter (1Q23) contract decreased by 18 per cent MoM to US$205. A range of US$200-300 is expected with an average of US$240 in 2023. The API4 Cal23 contract fell 16 per cent MoM to US$199. In 2023 the price is expected to range between US$180-280 with an average of US$230.

Petcoke

With the decline in coal prices, petcoke has fallen back to the neutral zone and seen stable in US dollar terms with demand fading out. It remains the cheapest fuel. Venezuelan product has been seen in several destinations, inhibiting mid-sulphur range prices.

As long as the coal price is declining at the current speed, buyers are holding back. The low water levels on the Mississippi River result in some product not reaching the export ports.

There is no specific petcoke news and the trends in the coal market, including Russian discounts for Turkey and India, and China that do not apply sanctions against Russia, will keep a lid on petcoke prices.

Based on low PMIs, global cement demand could be in danger of falling, but the petcoke market is expected to be stable.

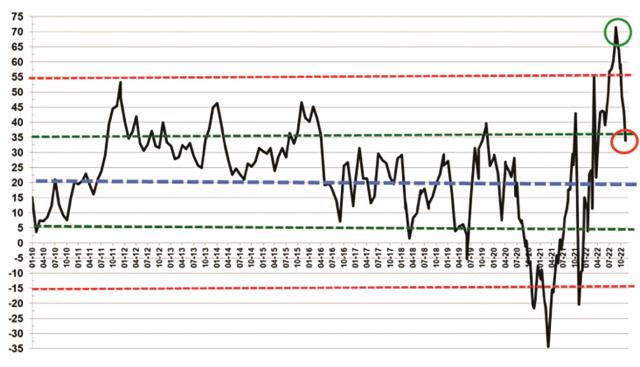

Petcoke discount to coal (API2 USGC 6.5% USGC ARA based on 6000kcal) – Dec 2022: 34%

The USGC FOB 6.5 per cent sulphur (S) contract is up three per cent MoM to US$142, with the discount to API4 sharply down to 45 per cent. The USGC CFR ARA 6.5 per cent S contract is up one per cent MoM to US$165 as a result of lower freight rates of US$23 with the discount in neutral down from 49 to 34 per cent.

The USGC FOB 4.5 per cent S contract is up three per cent MoM at US$152, with the discount to API4 down to 41 per cent. The CFR ARA 4.5 per cent contract is up one per cent MoM to US$175, with the discount down to 30 per cent towards API2.