By Frank O. Brannvoll, Brannvoll ApS, Denmark

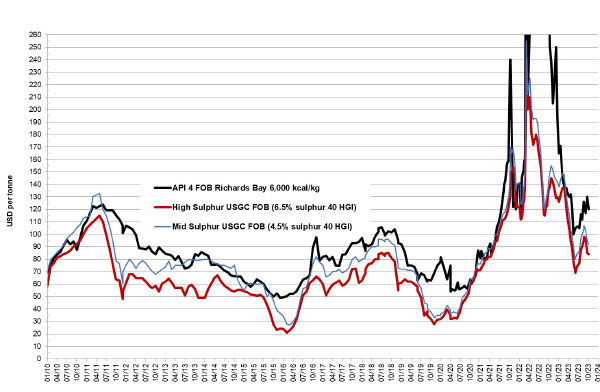

Coal was driven higher by the energy complex responding to the Israel-Gaza war and is now at the top of the US$100-140 range.

Petcoke reversed its fall as its discount increased, creating a switch from coal. After reaching the major support at US$80, petcoke bounced back and will now follow coal, possibly at the top of the range.

Petcoke with 6.5 per cent S is expected to continue in the US$80-95 range with resistance at US$95, US$105, US$115 and US$135. Support is at US$80, US$68 and US$55 with multi-year support at US$37. For 2024 a broad range of US$70-115 is expected.

Petcoke reversed its fall and its discount to coal increased

The discount for 6.5 per cent S petcoke FOB sold at US$89 is at 47 per cent when compared with API4 coal sold at US$134 in the 4Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$112 is at a discount of 35 per cent, when compared with API2 coal sold at US$138 in the 4Q23.

Freight rates are increasing with the USGC-ARA rate at US$23.