By Brannvoll Aps, Denmark

The euro is seen in the US$1.17-1.20 range with the US infrastructure package expected to support the dollar in the short-term. As forecast, inflation fears evaporated but the expected turn in commodities did not occur due to continued bottlenecks in the opening economies.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

69.25 |

|

|

Coal |

API2 – 4Q21 (US$) |

132.00 |

|

API2 – Cal 2022 (US$) |

100.00 |

|

|

API4 – 4Q21 (US$) |

135.00 |

|

|

API4 – Cal 2022 (US$) |

106.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

117.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

147.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

112.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

142.00 |

Crude oil

OPEC+ found an agreement in July, and the current production cuts will continue until December 2022 while the UAE, Iraq, Saudi Arabia and Russia will have new baselines from May 2022. Output will be lifted 0.4mbd from August until December 2022. Meanwhile, in December 2021 OPEC will assess market developments and the organisation’s performance.

The new agreement and new restrictions to curb the potential impact of the COVID-19 Delta variant on demand, saw the price of oil falling in July-early August. Short-term spikes were seen after Iran orchestrated an attack on an oil tanker in the Persian Gulf and combined with expectations that Iran will not return to the market soon after the elections due to slow progress in the nuclear deal.

The price of Brent oil fell eight per cent to US$69.25, down from US$75 with resistance at US$72 and US$76. Support is at US$67, a break here could lead to targets of US$63 and US$61. The stochastic sell signal from August came through and a trading range of US$67-74 can be expected. Brannvoll retains its forecast to an average of US$65 in 2021 within a range of US$55-80.

Coal

Once again, there was a sharp rally in coal, setting decade-highs to reach prices last seen in 2009. Increased demand due to sharply-higher gas prices in August has even seen Europe increasing its import of coal with German demand up 12 per cent in 2021. Distortions in Russian rail transport as well as political tensions in South Africa all disrupted supply. In China the NDRC has opened up for new coal mines and eased several conditions to increase production. However, new highs of CNY1065 (US$165) were still seen in China, while Colombian exports were slowly starting up. Lower Indonesian exports supported the market. Despite high CO2 prices in Europe, the dark spread is still better than the spark spread, leading power producers to use coal.

The API2 front-quarter (4Q21) contract rallied 19 per cent to US$132, back to 2009 levels. Resistance is now at US$133, US$140 and ultimately US$150, while support is at US$120 and US$102. A range of US$120-140 is expected. The API2 Cal22 contract traded 16 per cent higher at US$100 with resistance at US$102 and US$112. Support is at US$95 and US$88 in a defined uptrend, with an expected trading range of US$92-105.

The API4 4Q21 rallied 18 per cent to US$135, also a decade-high from 2009. Resistance is now found at US$140 and US$150 while support is at US$120 and US$110. The expected range is US$125-145. The API4 Cal22 contract “only” rose 11 per cent to US$106, still in steep uptrend breaking US$100 resistance at US$108 and US$115. Support is seen at US$100 and US$93. The expected range is US$98-115.

Petcoke

Petcoke repeated the story from last month with new highs, as the continued rally in coal prices still makes petcoke relatively competitive. There is new demand from cement producers in India and Turkey. Several petcoke tenders are seen out but often ending with coal purchases due to buyers refusing to pay new high prices. South American and Asian demand still increasing while China refuses the current price level. Buyers are trying to obtain domestic petcoke to avoid expensive freight costs, but production limits are being reached. Refiners’ capacity utilisation is now back at 91.3 per cent, which should increase petcoke production. However, some refineries have permanently closed their cookers, reducing output. Proxy coal hedging of petcoke as mentioned the last six months has proven a more than perfect hedge.

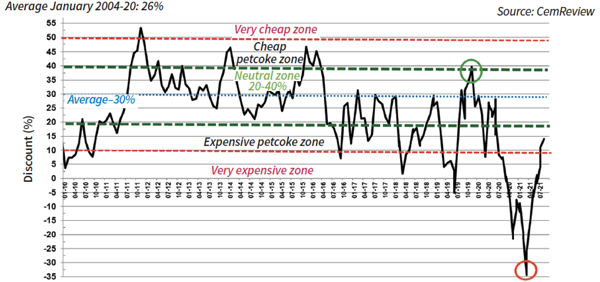

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Sep 2021: 14%

The sharp coal rally has made petcoke discounts wider and positive again for both FOB and ARA, driving demand back to petcoke.

Discounts continued higher on both FOB and ARA contracts due to the coal rally. Petcoke prices are now back to the 2010 highs with US$115 in sight.

The USGC FOB 6.5 per cent sulphur (S) contract rose seven per cent to US$112, with the discount to API4 at 34 per cent. A short-term range of US$105-115 is expected, potentially even to US$120. The ARA contract price equally rose seven per cent to US$142 and increased its discount to API2 to 14 per cent. The USGC FOB 4.5 per cent S contract rose seven per cent to US$117, representing a 31 per cent FOB discount. It is forecast to trade between US$110-125. The ARA rate of US$147 is up seven per cent, now offering real value for the first time in 2021.

The spread between 4.5 and 6.5 per cent petcoke is stable at US$4-6.

The petcoke rally has been driven sharply up month after month by coal with expected highs exceeded by decade highs. Oil is now also lacking momentum: this may be the first signal for a top, but one has to watch the coal and consider proxy hedging still.

Additional context is provided by carbon and freight market data in this month's issue of International Cement Review.