By Frank O. Brannvoll, Brannvoll ApS, Denmark

The euro holding tight US$1.15-1.17 trading range in the wider US$1.15-1.20 range.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

83.25 |

|

|

Coal |

API2 – 1Q22 (US$) |

125.00 |

|

API2 – Cal 2022 (US$) |

125.00 |

|

|

API4 – 1Q22 (US$) |

122.00 |

|

|

API4 – Cal 2022 (US$) |

105.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

168.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

202.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

154.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

188.00 |

Crude oil and gas

The oil market had little movement during October as all focus was on gas and coal. In November OPEC+ kept again to its strategy and did not give in to pressure for lowering the production cuts, as asked by US President Joe Biden and Japan.

Following a recent rally, the oil price has been stabilising between US$80-88. The Brent oil price rose three per cent to US$83.25, reaching US$88 but falling back as coal and gas declined. Resistance is at US$85 and US$88 with support at US$80 and US$76. For the next 12 months, Brannvoll ApS sees a US$60-100 range with an average of US$75.

Coal

In the coal market, China put itself firmly in focus. As domestic prices reached CNY2000 (US$312), the NDRC put a cap of CNY1200 (US$188) as FOB mine maximum, setting restrictions for coal power plants. Moreover, it allowed custom clearing and use of 2Mt of Australian coal to curb prices. The NDRC further lifted the prospect of a CNY440 (US$69) 20 per cent floating cap with a maximum price of CNY528 (US$83).

This fully punctured several speculative positions, including markets outside China, and massive selling led to stoploss of long positions and more than halved the price of both AP2 and API4 front prices. Fundamentals as such have not changed, but the speculative bubble burst and we are now seeing the market finding more realistic levels. The gas market is also coming lower but not at the same speed. More gas may approach Europe from Norway and Russia, with the latter still using the situation to promote Nord Stream 2.

The API2 front-quarter (1Q22) contract fell 50 per cent to US$125, having topped at US$280. Support is at US$120 and US$110 with resistance at US$150 and US$180 while a risk of high volatility remains. The API2 Cal22 contract declined 14 per cent to US$125. Support is at US$120 and US$100 with an upside risk to US$130 and US$150. The expected range is between US$110-150 depending on news from China.

The API4 front-quarter (1Q22) also collapsed 50 per cent to US$122 , following API2, with new support at US$110 and US$100 in a very oversold market. The upside risk is at US$140 and US$160, bearing in mind the highs of €250 of last month. The API4 Cal22 contract dropped 40 per cent to a low of US$105, having tested support at US$90. The upside is now capped at US$120 and US$140 with an expected range of US$100-130 depending on Chinese news. The markets are sharply oversold and volatility is expected to persist.

Petcoke

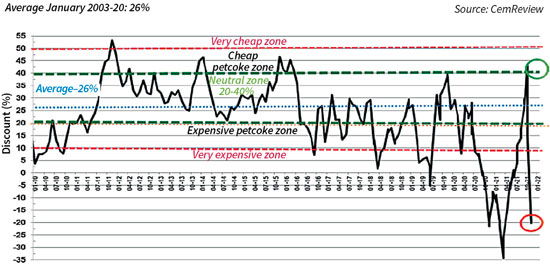

The petcoke market has been very stable. However, coal increased 100 per cent and then collapsed by 50 per cent and is now staying almost at the same levels. This has moved the discount from an extremely cheap petcoke even at high prices. With little material in the spot market, companies hunted the discount. India and China are returning to the buy side.

With coal’s collapse and persistent buying of petcoke, the discount has totally disappeared. Petcoke is now expensive on both price and in terms of its premium to coal on CIF ARA. As a result, it is expected that companies will switch to coal again where possible. This will put a downward pressure on petcoke prices but as most trade is on index-linked contracts, this may take its time well into the 1Q22.

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Dec 2021: -20%

The USGC FOB 6.5 per cent contract set a new all-time high, up 18 per cent to an all-time high of US$154 with the discount to API4 down from 57 per cent to zero. Demand is likely to contract and a range between US$140-155 can be now expected. The ARA contract price rose 15 per cent to US$188 and the discount turned to a premium of 20 per cent, in the very expensive petcoke zone.

The USGC FOB 4.5 per cent contract rose 18 per cent to an all-time high of US$164, with a 10 per cent premium, down from 63 per cent in a month. The downside is limited by a lack of supply upside. Coal has fallen and a range US$150-165 can be expected. The ARA rate of US$202 is up 15 per cent, now at a premium of 29 per cent to coal, a fall of 68 per cent for one month, and will turn cement companies towards purchasing coal where possible.

The spread between 4.5 and 6.5 per cent petcoke further widened above the normal US$4-6 to US$14, but is seen at a stable US$10-20. Demand could narrow again as demand for high-sulphur petcoke has been increasing. Moreover, Turkey has changed its rules for sulphur content and could see higher demand for higher-S types as well as lower-quality coal.