By Frank O. Brannvoll, Brannvoll ApS, Denmark

The euro broke lower due to hawkish talk from the US Federal Reserve of higher yields in 2022. There is a range of US$1.12-1.16 expected in 2022, but the euro is likely move towards US$1.18.

The Turkish lira saw a 47 per cent collapse from TRY9.75 to TRY14.40 in four weeks due to the new policy of negative real rates, making fuels substantially more expensive for Turkish cement makers.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

75.50 |

|

|

Coal |

API2 – 1Q22 (US$) |

130.00 |

|

API2 – Cal 2022 (US$) |

115.00 |

|

|

API4 – 1Q22 (US$) |

127.00 |

|

|

API4 – Cal 2022 (US$) |

115.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

140.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

174.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

125.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

159.00 |

Crude oil and gas

The oil market saw a sharp fall from US$85 to support at US$67 in fear of a demand collapse as the new Omicron COVID-19 variant caused new lockdowns of economies. However, a sharp upturn towards US$75 was noted following signs that this variant may not be as harmful as expected and despite some disappointment in the Western world that the vaccines are not shielding as expected.

OPEC+ did not budge in the face of pressure from USA and kept to its planned increase of 0.4mbd from January 2022. The next meeting is scheduled for 4 January 2022. However, some pressure did come to the market as the US published a release of 50mb from its strategic reserves.

The Brent oil price rose nine per cent to US$75.50. Resistance is at US$76 and US$80 with support tested at US$67. For the next 12 months, Brannvoll ApS sees a US$60-100 range with an average of US$75.

Coal

No real specific coal news for the month. Chinese prices came back up based on supply disruptions, but production has been increased. As a result, the price stays below the CNY1200 maximum price at CNY1180 (US$185).

While coal was first down on Omicron news, as gas prices started to rally again, it was seen in Europe as by far the cheapest fuel for power generation, which increased demand in a region used to falling demand. Coal-fired power plants are 5-8 times more profitable than gas-fired plants. As disruptions on Russia’s rail network and some unrest in South Africa occurred, prices have slightly increased again.

It is interesting that the financial index API4 FOB from South Africa may cease to be calculated and traded from next year.

The API2 front-quarter (1Q22) contract rose five per cent to US$130. Support is at US$120 and US$110 with resistance at US$150 and US$180, while a risk of high volatility remains. The API2 Cal22 contract declined eight per cent to US$115. Support is at US$110 and US$100 with an upside risk to US$130 and US$150. The expected range is between US$110-130, mostly reflecting gas prices and weather forecasts for January-February 2022.

The API4 front-quarter (1Q22) rose four per cent to US$127, with support still at US$110 and US$100. Upside risk is at US$140 and US$160. The API4 Cal22 contract was up nine per cent to US$115 with support at US$100. The upside risk is now capped at US$120 and US$140 with an expected range of US$100-130.

Petcoke

Petcoke finally started to give in based on demand pull-back and increased supply as refineries are running on higher capacity utilisation levels.

The discounts had disappeared and coal switching was seen in India, China and Turkey. Demand in Turkey was also hampered by a sharply falling lira. The spot market saw more cargoes and the refineries have to get the petcoke out, now facing a lack of demand based on the lower coal prices. Depending on coal and gas prices the petcoke market on CIF destinations could easily see a further 10 per cent drop to persuade buyers to return to the petcoke market. Brannvoll expects the petcoke indices that are lagging to continue downwards and most on the liquid 6.5 per cent sulphur (S) as 4.5 per cent S will have more buyers that cannot switch easily. However, Turkey may now substitute with US coal.

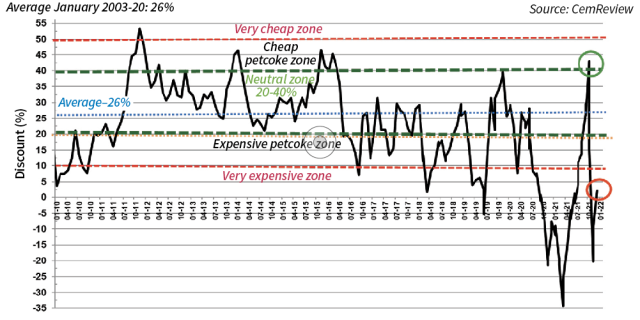

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jan 2022: -2%

The USGC FOB 6.5 per cent S contract fell 19 per cent to US$125 from record levels with the discount to API4 up from zero to 21 per cent. A range between US$115-140 can now be expected. The ARA contract price fell 15 per cent to US$159 and the discount returned to two per cent in the expensive zone.

The USGC FOB 4.5 per cent S contract declined 17 per cent US$140 with a 12 per cent premium. The downside is limited by a lack of supply upside. A range of US$125-150 can be expected. The ARA rate of US$159 represents a fall of 22 per cent but remains at a premium of seven per cent to API2.

The spread between 4.5 and 6.5 per cent petcoke further widened above the normal US$4-6 to US$15 but is expected to stay in US$10-25 range. High sulphur contracts are falling faster.