In the USG Supramax freight market, uncertainty was the common denominator throughout the whole month. Fixing activity was limited as many players were reluctant to fix until further notice from the US regarding tariffs for the Chinese-built vessels.

The new US import tariffs for other nations continued to be the hot topics. Amid a potential trade war, the market sentiment was poor, while rates were holding largely steady, just minor negative corrections were observed on transatlantic routes.

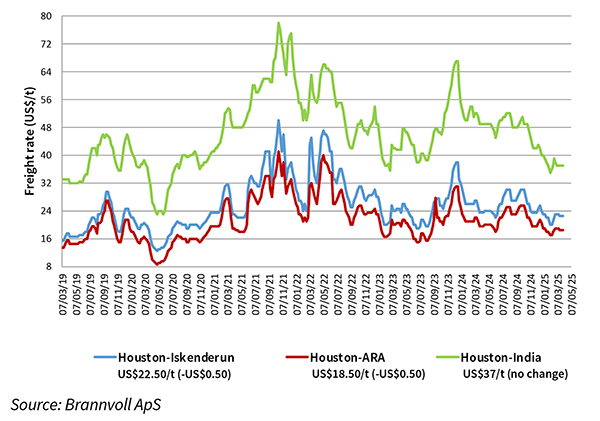

Freight rates for transportation of a Supramax-lot of petcoke from Houston to ARA ports with spot laycans are at US$18.50/t on average. Deals for delivery of 50,000t of petcoke from Houston to Iskenderun with spot laycans are discussed at ~US$22.50/t on average. Shipping costs for delivery of a Supramax-lot of petcoke from USG to EC India are at US$37/t on average.

The future picture of the freight market in USG is likely to be determined by the US Trade Representative’s decisions and clauses. Thus, if the decision regarding tariffs for Chinese-built vessels is confirmed in the US, we could start to see non-Chinese vessels paying a premium.

Imposing import tariffs will cause the trade flows to change, and most probably, US imports will decrease, which eventually might weaken the USG freight market.

by Brannvoll ApS, Denmark