By Frank O. Brannvoll, Brannvoll ApS, Denmark

The markets were still firmly driven by any news from Russia’s war on Ukraine: peace talks will lead to a falling market while new sanctions increase upward pressure. The coal markets were extremely impacted by the EU ban on Russian coal imports from August. However, this will create opportunities for cheaper coal in countries not part of the embargo.

The euro testing the lower part of the US$1.07-1.12 range is still also reflecting higher inflation where the US Federal Reserve may be raising rates faster than the European Central Bank. The Turkish lira has fallen to TRY14.75 with risk upwards due to a high negative real yield.

|

Prices at a glance |

|

| Crude oil - bbl | US$102.00 |

| Coal API2 - 3Q22 | US$300.00 |

| - Cal2023 | US$235.00 |

| Coal API4 - 3Q22 | US$275.00 |

| - Cal2023 | US$195.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$225.00 |

| CFR ARA |

US$251.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$210.00 |

| CFR ARA | US$236.00 |

Oil and gas

The gas market retraced as gas was not being sanctioned and flows continued from Russia through Ukraine towards the EU. Russia’s demand for payment of gas in rubles seems to have been solved as banks are carrying out the euro-to-ruble exchange in Russia.

The US gas market seems to be the winner as LNG will now flow to the EU based on new large contracts, lowering the immediate pressure on TTF prices.

The oil market fell below US$100 as US and IEA countries will release 180m and 60m barrels, respectively, which should offset the 1-2mbd drop in Russian exports for some months. OPEC+ once again decided to stick to the planned 0.4mbd increase and as a result, the feared shortage did not materialise. Russian oil is now sold at increasing discounts to new buyers without sanctions. The EU avoided direct sanctions as 30 per cent of the oil comes from Russia.

In China the outbreak of COVID-19 and lockdowns have reduced its oil import again.

Oil is expected to trade in the range of US$95-115, depending on the outcome of war and peace talks.

Coal

Coal prices fell sharply from the March 2022 highs but have regained their uptrend after the EU decided to ban any import or trading of Russian coal as Russia delivers 70 per cent of the API2. However, Russian coal is now sold with big discounts, which may benefit countries such as Turkey that do not take part in sanctions. Fears of supply shortages or a much higher freight cost from South Africa, less than from Colombia or even Australia, is reflected in the market. EU demand for coal has risen 40 per cent in 2022. To date considerable demand destruction has not occurred, but the European energy-intensive industries have asked the EU for support if these levels persist.

In China a new band of CNY570-770 (US$90-120) was introduced by the NDRC for long-term domestic coal contracts. However, this is far below world spot markets and saw Chinese buyers shy away from imports.

The API2 front-quarter (3Q22) fell 23 per cent from US$390 in the previous issue to US$300, but was up from US$225 seen in April. A range of US$225-350 is expected. The API2 Cal23 increased 23 per cent MoM to US$235. A range of US$180-275 is expected.

The API4 front-quarter (3Q22) contract fell by 25 per cent to US$275 but rose from US$205 in April with a range of US$225-325 forecast. The API4 Cal23 increased 14 per cent to US$195, with a forecast between US$175-250.

Petcoke

The petcoke market was again in the shadow of the developments in Ukraine and the impact on coal markets. With the rallies in coal, petcoke is still seen as “cheap” but at the same time, saw new all-time highs.

The spot market has been very illiquid and with just a few tenders from refineries as people are afraid of the recent volatility. Most trades are based on the indices and long-term contracts.

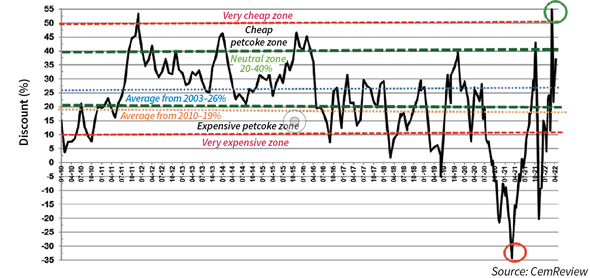

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: April 2022: 37%

Both in China and India imports have been very low as buyers look for domestic production, particularly in China due to lower domestic coal prices. USGC production is now back to pre-COVID-19 levels and, therefore, supply pressure is easing and leading to higher discounts as petcoke is no longer scarce. Credit issues between trading partners are an increasing problem with these price levels.

Demand has been steady for mid-sulphur product, increasing the spread to high-sulphur types.

Bid and asking prices in the market are still very wide, which makes specific price estimation difficult. The USGC FOB 6.5 per cent sulphur contract is estimated at US$210, up 10 per cent MoM from US$190, with the discount to API4 at 39 per cent, lower than in the previous issue, due to an extreme coal price. USGC CFR ARA 6.5 per cent contract is up seven per cent to US$236. The discount to API2 at 37 per cent is in the neutral zone.

For 4.5 per cent sulphur petcoke the USGC FOB is estimated at US$225, up 11 per cent MoM from US$205 with the discount to API4 at 35 per cent. The CFR ARA contract is estimated at US$56 with a discount at 33 per cent.

The spread between 4.5 and 6.5 per cent is estimated at US$15 but seen higher in the market, up to US$25.