Since ICR’s most recent energy report, the energy complex is awaiting the impact of sanctions on Russia and the risk of an economic slowdown. Oil prices increased to US$100-115 on the back of the EU’s potential sanctions on Russian oil.

Coal is stabilising after rising on demand before the sanctions in August with Russia offering a discount.

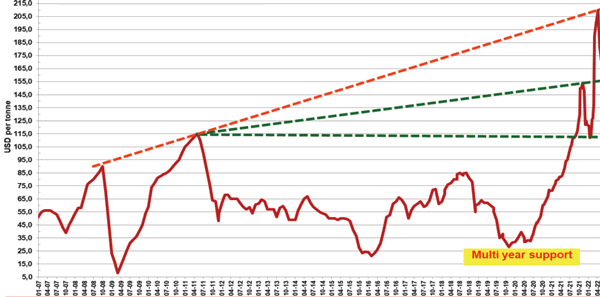

High-sulphur petcoke (6.5%) 40HGI FOB USGC – historical view 2007-22

Meanwhile, petcoke stabilised on a high discount on current levels with increased supply, but there is a return on demand. Freight rates softened slightly but also stabilised, leaving petcoke now in the very cheap zone. In terms of petcoke prices, high-sulphur petcoke (6.5 per cent) trades in the expected range of US$165-200. Resistance is found at US$200, 215, 235 and 250 while support is at US$170, 155 and 115. Multi-year support is at US$35.

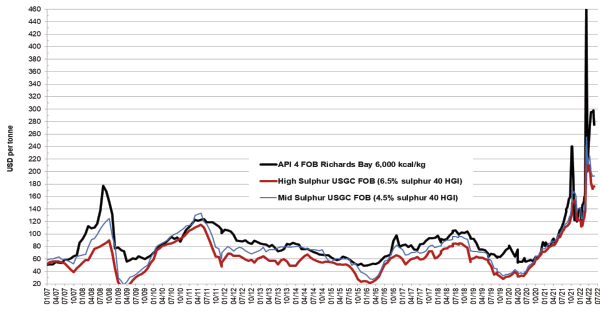

Steam coal and petcoke FOB prices - historical view 2007-22

The discount for petcoke FOB with 6.5 per cent sulphur sold at US$176 (compared with API4 3Q22 coal at US$275) is 49 per cent. The discount for petcoke (6.5 per cent sulphur) CIF ARA sold at US$213 (compared with API2 3Q22 coal at US$280), is 39 per cent.