By Frank O. Brannvoll, Brannvoll ApS, Denmark

Another month driven by war in Ukraine, imminent EU sanctions pushing energy prices upwards, and central banks raising interest rates on the back of increased inflation pressures. As a result, analysts are fearing a recession with a potential fall in energy demand. However, the EU sanctions against Russia are starting to hurt European countries. In addition, strict COVID-19 lockdowns in China are also dampening domestic demand. As a result, prices have been less volatile than in previous months. The strength of the US dollar also keeps commodity prices lower. The US currency is seen as a “safe haven”. The euro has fallen below 1.07 and is now testing the major support at 1.05. A range between 1.045-1.1 is expected.

|

Prices at a glance |

|

| Crude oil - bbl | US$113.00 |

| Coal API2 - 3Q22 | US$302.00 |

| - Cal2023 | US$250.00 |

| Coal API4 - 3Q22 | US$295.00 |

| - Cal2023 | US$230.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$172.00 |

| CFR ARA |

US$212.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$192.00 |

| CFR ARA | US$232.00 |

Oil and gas

The oil market fell due to sizeable releases from US reserves and lockdowns in China. It went sharply higher following EU talks of new sanctions including a six-month phase-out of oil imports from Russia, which accounts for 30 per cent of EU oil imports. These 3.5mb/d must be replaced. OPEC+ is on track, raising output 0.43mb/d in May to 42.6mb/d but delivering over 1mb/d less. Russia, which produces 35 per cent of OPEC crude oil, is already selling with record-high discounts to India and non-sanction Asian countries.

As Poland and Bulgaria refused to pay for Russian gas deliveries in Russian rubles, deliveries were stopped, triggering higher gas prices. Companies are now finding ways to overcome the forex issue and gas is delivered from Russia with TTF falling. Russia delivers 40 per cent of EU gas imports.

Brent oil reached US$113 and is expected to range trade between US$95-115, depending on the outcome of peace and sanctions talks.

Coal

Coal increased on back of the new EU sanctions, while coal-fired electricity generation rose due to high dark spreads. Russia is exporting massively into ARA before sanctions come into force in August and ARA stocks have risen to new highs. In addition, Russian coal sold with big discounts benefitting countries that have not imposed sanctions.

The market is searching for alternative high-calorific qualities. South Africa is not able to increase exports as much as needed, but API4 prices are narrowing the gap to API2. Colombia is slowly coming back to the markets.

China lockdowns and low domestic regulated prices are also keeping imports lower. India is seeking to import more coal as domestic production is not able to fulfill the major increase in demand.

The API2 front-quarter (3Q22) contract is steady at 0.7 per cent from the previous issue from US$300 to US$302. A range of US$250-350 is expected. The API2 Cal23 increased six per cent MoM to US$250. A range of US$200-275 is expected.

The API4 front-quarter (3Q22) contract rose by seven per cent to US$295, with an expected range of US$250-325. The API4 Cal23 increased sharply by 18 per cent to US$230, with an expected range of US$195-230.

Petcoke

The petcoke market has fallen sharply since the last issue, reflecting increased supply and buyers stepping back from very high delivered prices.

China’s lockdowns and low domestic regulated coal prices has lowered petcoke imports, while real term prices also kept buyers away, leading to the sharp price corrections seen in April. However, FOB and destinations discounts are currently rising, making petcoke attractive when compared to coal. Indian traders have returned to the market, while refineries are lowering their offers due to increased freight rates and a higher US dollar. US refinery capacity has fallen from 93 to 88 per cent, but cracking to diesel was up, ensuring petcoke supply is increased. Demand from Turkey for the mid-market has been low due to huge discounts on Russian coal.

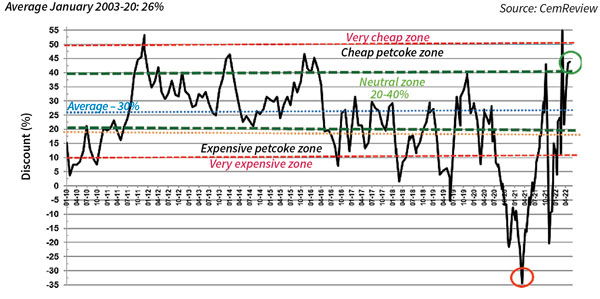

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: May 2022: 44%

Trades were reported in the US$160-169 range for 6.5 per cent sulphur (S) FOB, but the latest coal price increases have put a floor under the fall in petcoke. Bid and asking prices in the market are coming closer as prices have fallen and discounts increased.

The USGC FOB 6.5 per cent S contract is estimated at US$172, down 18 per cent MoM from US$210, with the discount to API4 at 53 per cent, back in the cheap petcoke zone. The USGC CFR ARA 6.5 per cent S contract is only down 10 per cent to US$212 due to higher freight costs.

For 4.5 per cent S petcoke the USGC FOB is estimated at US$192, down 14 per cent MoM from US$225 with the discount to API4 at 44 per cent. The CFR ARA contract is estimated at US$232 with a discount at 38 per cent.

The spread between 4.5 and 6.5 per cent widened to US$20 due to a steady demand for medium-sulphur petcoke.