By Frank O. Brannvoll, Brannvoll ApS, Denmark

Since ICR’s most recent energy report, the energy complex is falling as higher yields slow economies and EU purchases have slowed following full stocks. Russia’s continued discounts on coal see prices slip with API4 coal now trading at US$238. Oil is stabilising above US$90 after OPEC+ cut supply by 2mbpd. In Europe gas prices have been slipping as reservoirs are being filled and the weather stays warm.

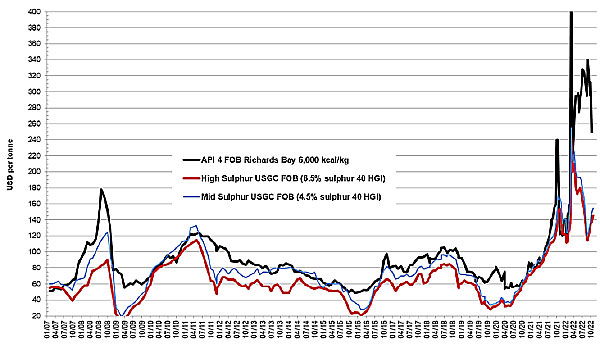

Steam coal and petcoke prices FOB

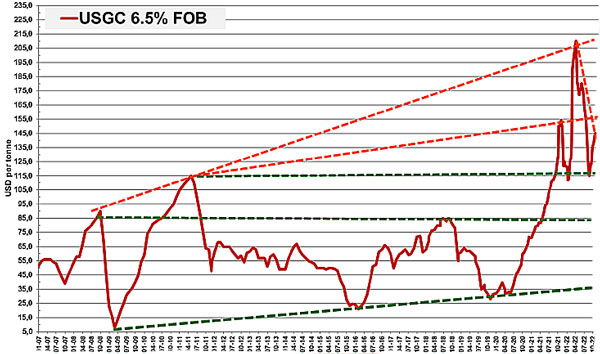

Petcoke prices continue to rise on new demand from China and India, with the discount to coal falling sharply. However, petcoke is still a “cheap” fuel at these rates when compared to coal (API2 and API4). The high-sulphur (6.5 per cent S) petcoke FOB contract is currently at US$145, with an expected trading range of US$115-150. Resistance is to be found at US$155, 180 and 215, while support is around US$125, 115, 100 and 85. Multi-year support is found at US$36.

High-sulphur petcoke (6.5%) 40HGI FOB USGC -

historical view 2007-22

The discount for 6.5 per cent S petcoke FOB sold at US$145 is at 51 per cent when compared with 4Q22 API4 coal sold at US$238. The CIF ARA 6.5 per cent S petcoke contract sold at US$170.50 is at a discount of 43 per cent, when compared with 4Q22 API2 coal sold at US$242.

Freight rates stabilised with the USGC-ARA contract at US$25.