By Frank O. Brannvoll, Brannvoll ApS, Denmark

There has been very little direct news in the carbon market, as political discussions of changes to the EU ETS are still ongoing, and are driven by the movements in the fuel market.

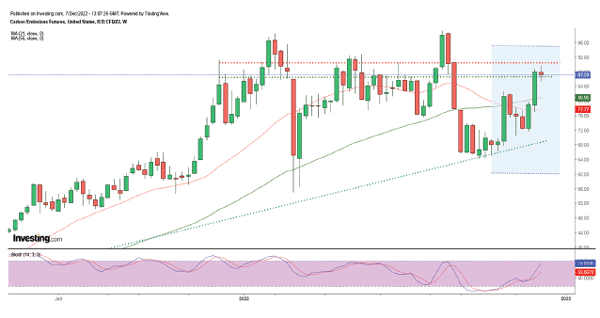

However, the market, which had been stuck in the EUR65-75 range, broke out to the upside as year end is approaching and compliance buying and short positions closing from speculative trades have propelled the market upwards.

From a warm winter the start of December has seen a cold snap in Europe, which increased the demand for fossil fuels and EUAs, driving it through the EUR75 resistance with a sharp rally to the EUR90 resistance.

EUA front-year contract, July 2018-December 2020

As the contract will change to December 2023, a new range between EUR80-95 has been seen. Support is seen at EUR85 and EUR80.

For 2023 Brannvoll ApS expects a range of EUR60-95, with an average of EUR82.

Issues on the political agenda include:

• an increase in the linear reduction factor (LRF) to 4.2 from 2.2 per cent from 2024

• a reduction of 177m allowances in 2024

• keeping the Market Stability Reserve (MSR) intake at 24 per cent, not reducing it to 12 per cent in 2024

• phase out free allowances by introducing the Carbon Border Adjustment Mechanism (CBAM) between 2026-35

• the introduction of trading scheme for transport and buildings from 2025-27.