By Frank O. Brannvoll, Brannvoll ApS, Denmark

Inflation remains high and central banks continue to increase interest rates albeit at a slower pace. This has now led to widespread expectations of recession not only in the EU, which is hurt by energy sanctions, but also in the US as its Federal Reserve maintains a very aggressive stance.

The oil market has fallen below US$80, but is decoupled from the gas and coal markets, which are disrupted by the energy sanctions on Russia. The increasing winter cold has led to higher gas prices and has driven coal prices in Europe sharply upwards again.

The war in Ukraine could potentially be in its last phase as frontlines seem to freeze. Moreover, war fatigue is also spreading in Europe with attention moving towards addressing the high inflation rate and the region’s economic outlook.

The euro has regained terrain and is now back to US$1.05, as the US dollar retraced on the overall US dollar index too.

For 2023 Brannvoll ApS expects the euro to move within a range of US$0.90-1.10, with an average of US$1.02.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$79.50 | |

| Coal API2 |

1Q23 | US$265.00 |

| Cal 2023 |

US$250.00 | |

| Coal API4 |

1Q23 | US$250.00 |

| Cal 2023 |

US$245.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$144.00 |

| 4.5% CFR ARA |

US$167.50 | |

| 6.5% 40HGI FOB | US$129.00 | |

| 6.5% CFR ARA | US$152.50 | |

Oil and gas

Oil fell after OPEC decided to keep production cuts unchanged at 2mbpd in December. However, reports of slower US demand pushed oil below US$80, which could trigger OPEC+ actions. The G7 introduction of a price cap on Russian oil at US$60 did not have any impact on the market as Russian oil was trading below this point and import countries such as India and China are not part of the agreement. However, lifting COVID-19 restrictions in China could be a supportive factor over the coming months.

The short-term range for Brent is expected to be US$75-90/bbl.

For 2023 Brannvoll ApS expects the oil price to move within a range of US$80-115/bbl, with an average of US$98/bbl.

Coal

The price of coal had fallen during October and November, but the return of cold weather in Europe and China, combined with supply disruptions in South Africa and Colombia, sent the prices sharply higher in the API2 and API4 markets.

Russian coal is still being sold at discount to Turkey and China, and record import numbers are being reported.

In China increased domestic production and high stocks have sent the prices lower, which was also reflected in the global markets. In addition, the loosening of COVID-19 restrictions has now increased demand and prices again.

Higher TTF gas prices in Europe, due to cold weather, has sent demand for coal surging, resulting in higher prices.

The API2 front-quarter (1Q23) contract jumped by 32 per cent MoM to US$265. The API2 Cal23 contract rose 28 per cent MoM at US$250. For 2023 Brannvoll ApS expects a range of US$200-300 with an average of US$225 for the quarterly and calendar year API2 contracts.

The API4 front-quarter (1Q23) contract increased by 22 per cent MoM to US$250. A range of US$200-300 is expected with an average of US$240 in 2023. The API4 Cal23 contract rose 23 per cent MoM to US$245. In 2023 the price is expected to range between US$180-280 with an average of US$230.

Petcoke

Despite the rise in coal prices, petcoke continued to decline at the end of the year as demand remained sluggish from India and China despite higher discounts.

In China the falling domestic coal price kept buyers on hold and in Turkey low-priced Russian coal set a lower discount combined with a fall in clinker production of 15 per cent YoY.

US production has been stable and refiners are avoiding the build-up of stocks that are too large, offering product at lower prices to maintain short-term buyers in their comfort zone.

Venezuelan product has been seen in several destinations with significant volume increases to Turkey, putting a lid on mid-sulphur range prices, which remain high compared to the normal US$10 spread.

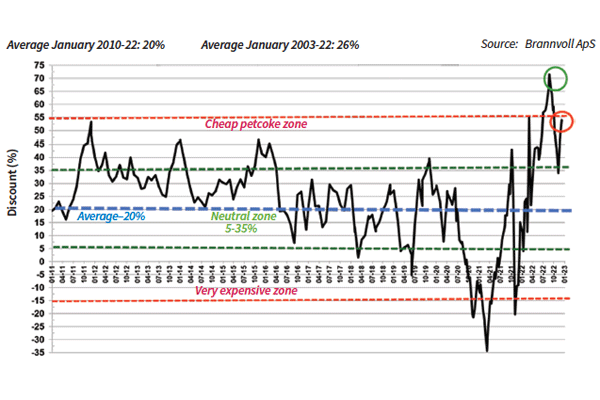

The USGC FOB 6.5 per cent sulphur (S) contract is down nine per cent MoM to US$129, with the discount to API4 sharply higher to 59 per cent. The USGC CFR ARA 6.5 per cent S contract fell by eight per cent MoM to US$152.50 with freight rates of US$23.50 with the discount rising to 54 per cent compared to API2 and settling in the cheap zone.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jun 2021: -1%

The USGC FOB 4.5 per cent S contract is down five per cent MoM at US$144, with the discount to API4 rising to 54 per cent. The CFR ARA 4.5 per cent contract decreased by four per cent MoM to US$167.50, with the discount jumping to 49 per cent towards API2.