By Frank O. Brannvoll, Brannvoll ApS, Denmark

The central banks continued interest rate hikes with 0.50 per cent in December, promising more to come. This has led to greater expectations of recession and falling demand, and in combination with thin trading in December, the overall energy index has fallen. The EU has introduced windfall profits on power producers and maximum gas prices. In Europe the winter has also been unusually warm for December and January, lowering heating demand.

Meanwhile, the frontline in Ukraine is frozen despite continued fighting. Rumours of peace negotiations are circulating as war fatigue is spreading in Europe.

The euro kept appreciating and is now back to US$1.06 with a forecast range of US$1.02-1.07. Following an interest rate reduction, a potential move in the US$-TRY is on the cards.

For 2023 Brannvoll ApS expects the euro to move within a range of US$0.90-1.10, with an average of US$1.02.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$78.50 | |

| Coal API2 |

1Q23 | US$177.00 |

| Cal 2023 |

US$168.00 | |

| Coal API4 |

1Q23 | US$165.00 |

| Cal 2023 |

US$160.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$138.00 |

| 4.5% CFR ARA |

US$161.00 | |

| 6.5% 40HGI FOB | US$126.00 | |

| 6.5% CFR ARA | US$149.00 | |

Oil and gas

After the IEA adjusted the oil demand for 2023 down to 1.7mb/d from 2.3mb/d, oil has been volatile between US$75-85/bbl.

The opening of China was seen as a bullish move, but the rapid spread of COVID-19 has now lowered the demand from China as output has fallen.

The G7 and EU oil cap for Russian oil has still had no effect as Russia is selling to India, China and other non-sanction countries, so Russian supply has not vanished. Venezuela has again been exporting oil to the USA and this is also seen as a green light for petcoke export. TTF gas prices in Europe dropped sharply due to full inventories and warm winter weather. As a result, they are now back to pre-Ukraine invasion levels but remain three times higher than in the summer of 2021.

The short-term range for Brent is expected to be US$75-88/bbl.

For 2023 Brannvoll ApS expects the oil price to move within a range of US$80-115/bbl, with an average of US$98/bbl.

Coal

The price of coal fell sharply in December following the drop in the overall energy complex, increasing supply at a time of lower demand and sharply fallen gas prices in Europe.

The big news is that China has allowed four companies to import Australian coal again and that Indonesian export is back on full. The supply disruptions in South Africa and Colombia have been resolved, adding supply to a market with lower demand.

Russian coal has still been sold massively at discount to Turkey, China and India. Russian exports increased in 2022 despite a 38 per cent drop in EU imports due to sanctions.

The API2 front-quarter (2Q23) contract fell by 33 per cent MoM to US$177. The API2 Cal24 contract fell 33 per cent MoM at US$168. These levels could be considered as buying opportunities. For 2023 Brannvoll ApS expects a range of US$200-300 with an average of US$225 for the quarterly and calendar year API2 contracts.

The API4 front-quarter (2Q23) contract fell by 34 per cent MoM to US$165. A range of US$200-300 is expected with an average of US$240 in 2023. The API4 Cal23 contract fell 36 per cent MoM to US$160. In 2023 the price is expected to range between US$180-280 with an average of US$230 and these lower levels could be seen as buying opportunities.

Petcoke

While there is no specific petcoke news, falling coal prices are putting pressure on the FOB prices and freight has been steady. Turkey has been buying less as coal became even more competitive, and the Christmas holidays lowered trading to a minimum.

Venezuela is still increasing its petcoke exports as less importance is given to US sanctions after oil deliveries.

US production is stable and refiners are offering product at lower prices in competition with sharply lower coal prices.

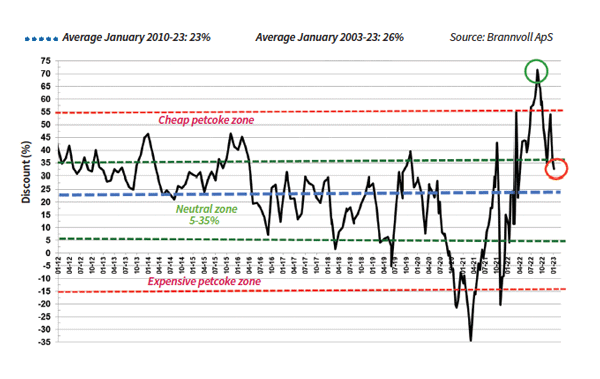

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jan 2023: 33%

The USGC FOB 6.5 per cent sulphur (S) contract is down two per cent MoM to US$126, with the discount to API4 sharply lower from 59 to 39 per cent. The USGC CFR ARA 6.5 per cent S contract fell by two per cent MoM to US$149, with freight rates steady at US$23 with the discount dropping to 33 and now moving into the neutral zone.

The USGC FOB 4.5 per cent S contract declined four per cent MoM at US$138, with the discount to API4 down to 33 per cent. The CFR ARA 4.5 per cent contract fell by four per cent MoM to US$161 with the discount also back in neutral at 27 per cent towards API2.