By Frank O. Brannvoll, Brannvoll ApS, Denmark

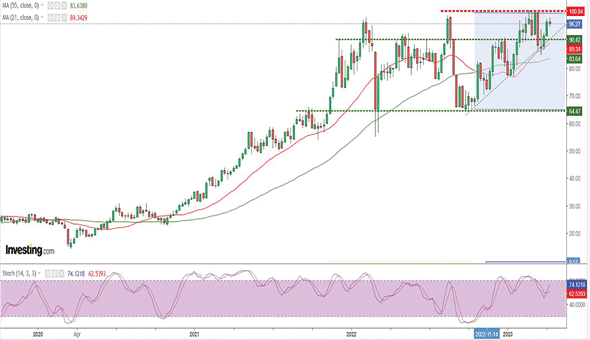

The cement sector has reduced its emissions with six per cent in 2022 compared to 2021 and Europe has lately seen a downtrend in the coal-fired power production, reducing demand for EUAs slightly. Despite this the market tested the EUR100 resistance again in March on less fear of recession, but the banking issues in the USA and Switzerland took speculators temporarily out of the market, setting it back on track for a range between EUR90-100 in the short term.

Compliance buying must be completed before 30 April 2023 and has led to buying on dips in the market.

The market is still on a long-term uptrend based on the new measures being implemented and a firm support is seen at EUR80.

Figure 1: EUA front-year contract, October 2020-April 2023

The EUA in Dec 2025 is trading at EUR105 and we see a steady contango up to 2030, when the price is EUR122.

Carbon Pulse’s latest survey, set an average forecast for 2023 at EUR82.20. Brannvoll ApS expects a range of EUR 60-100 with an average of EUR85 for 2023. For 2030 the survey expects an average of EUR110 while Brannvoll Aps puts its forecast higher at EUR160.