By Frank O. Brannvoll, Brannvoll ApS, Denmark

The story of inflation and central bank rate hikes continues. Inflation figures from the US were at five per cent in March, awaiting another 0.25 per cent hike from the Federal Reserve. The European Central Bank is also expected to raise rates as inflation remains high due to EU sanctions keeping energy prices relatively high to 2021 before sanctions. While banking problems have increased the fear of recession, China’s post-COVID opening up is positive for the markets. Moreover, with new involvement of China in the talks, a Russia-Ukraine peace agreement could surprise the markets and result in positive sentiment.

Meanwhile, the euro revisits US$1.10, and is testing the topside with US$1.07-1.12 range in short term. For 2023 Brannvoll ApS expects a range of US$0.90-1.10, with an average of US$1.02.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$87.30 | |

| Coal API2 |

2Q23 | US$128.00 |

| Cal 2024 |

US$132.00 | |

| Coal API4 |

2Q23 | US$130.00 |

| Cal 2024 |

US$134.50 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$113.00 |

| 4.5% CFR ARA |

US$133.50 | |

| 6.5% 40HGI FOB | US$103.00 | |

| 6.5% CFR ARA | US$123.50 | |

Oil and gas

Oil dropped to US$72 during March and OPEC+ stepped in with a surprise cut in production of 1.16mb/d while Russia cut 0.5mb/d. Added to the existing OPEC+ cuts of 2mb/d the total is now 3.66mb/d or 3.7 per cent of global demand. This sent oil prices sharply higher over Easter to US$87.30 and back in the US$80-90 range seen as the preferred zone of OPEC. This increase could spill into new inflation if oil goes above US$90 and thereby add more interest rate hikes, and again weaken energy demand.

Geopolitical risk is still on the topside with Chinese military exercises near Taiwan and US forces in the same area.

TTF gas in Europe ranges around EUR50 and challenges coal for power production for the first time in recent years. European storage is filled, including large volume of Russian LNG as this has been outside EU sanctions.

For 2023 Brannvoll ApS expects the oil price to move within a range of US$80-115/bbl, with an average of US$98/bbl.

Coal

Coal prices have found support around US$120 for API2 and API4, with Australian coal seen 20 per cent higher. Warmer weather, very high stocks and increase in supply have been keeping a steady downward pressure on the prices. There has been increased Indian and Chinese demand while the Russian discount has reduced, now consolidating in a lower range than just three months ago.

Since the start of 2023, Europe has decreased its import by 13 per cent, which it covers by a new increase in Colombian export as well as US coal. South Africa has been seen selling more to India and China. Australian exporters have signed the annual contract with Japanese utilities at US$200/t for 2023, down from US$395/t in 2022. Brannvoll recommends considering current price levels for purchasing cheaper than most budget rates.

The API2 front-quarter (2Q23) contract rose by seven per cent MoM to US$128, with a range of US$110-150 expected. The API2 Cal24 contract rose three per cent MoM at US$132. For 2023 Brannvoll ApS forecasts a range between US$120-220 with an average of US$170 for the quarterly and calendar year API2 contracts.

The API4 front-quarter (2Q23) contract rose by two per cent MoM to US$130, with a short-term range of US$120-150. Brannvoll ApS forecasts a range US$120-220 with an average of US$170 in 2023. The API4 Cal23 contract fell two per cent MoM to US$134. In 2023 the price is expected to range between US$125-225 with an average of US$175.

Petcoke

As predicted, petcoke prices continued the sharp declines due to low coal prices and fuel switching with supplies high as May-June stocks have been filled. China has large stocks and India completed most buying last month, forcing prices down to long-term support levels. Turkey has seen short term decline in demand after the earthquakes, but this could pick up over the next years as rebuilding will start for full. Cargoes were sold cheaper for other destinations.

Venezuelan export continues and has been seen in Indian markets, putting pressure on medium sulphur (S) contracts.

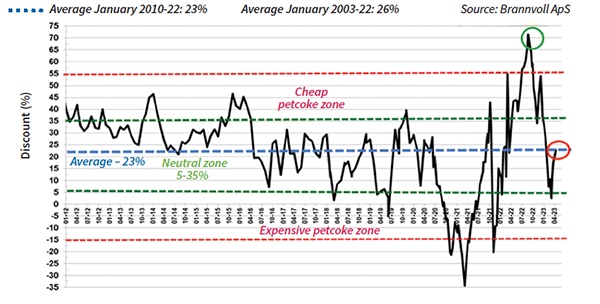

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: April 2023: 23%

The USGC FOB 6.5 per cent S contract is down 18 per cent MoM to US$103, with the discount to API4 rising from 21 to 37 per cent, back in neutral zone. The USGC CFR ARA 6.5 per cent S contract fell by 16 per cent MoM to US$123.50, and the discount sharply up from two to 23 per cent and now in the neutral zone. The USGC FOB 4.5 per cent S contract fell 16 per cent MoM at US$113, with the discount to API4 up to 31 per cent. The CFR ARA 4.5 per cent contract fell by 15 per cent MoM to US$133.50 with the discount back in positive of 17 per cent up from a premium. Petcoke has now reached and fallen below big support levels with a possible further US$5-10 drop. However, as coal prices have been rising lately, discounts could be tempting buyers soon.