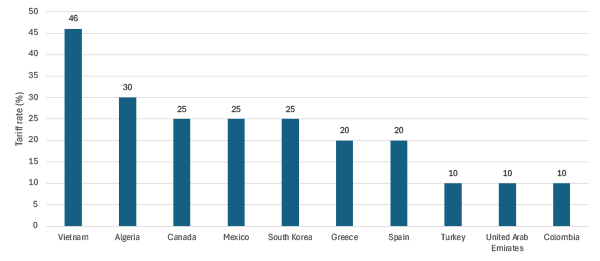

Canadian and Greek cement producers will be hit hardest by US tariffs. Adding to the already announced 25 per cent tariff on Canadian and Mexican imports, on 2 April the US administration revealed a plethora of tariffs on other countries, ranging from 10-50 per cent, and including 20 per cent on imports from the European Union, of which Greece is a member.

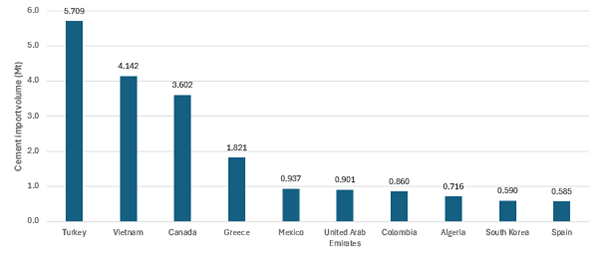

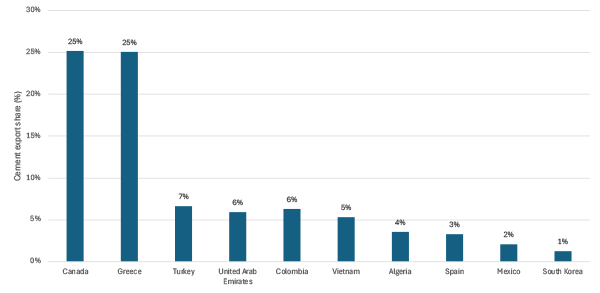

Cement exports to the USA account for a quarter of all cement produced in both Canada and Greece. Canadian exports to the USA amounted to 3.6Mt in 2024, while Greece supplied 1.8Mt. Both countries may look to pare-back production in the coming months.

Data from Statistics Canada show the value of cement produced in Canada amounted to CAD113,850 in January, an increase of 8.6 per cent YoY, though this is well below the 16.5 per cent YoY increase noted in January 2024. Total cement produced amounted to CAD5.5m in 2024, up 18.9 per cent YoY, while cement sales for the year amounted to CAD2.8m, up 3.9 per cent YoY.

Meanwhile, data from Eurostat show Greek cement manufacturing output expanded by just 0.5 per cent YoY in January, following a 6.1 per cent increase for 2024 as a whole.

Vietnam, the second most important supplier at 4.1Mt in 2024, exports just five per cent of its domestically produced cement to the USA. Nevertheless, the 46 per cent tariff – one of the highest announced and due to take effect on 9 April – will significantly curtail Vietnamese imports and dent activity at export-facing cement producers.

Total Vietnamese cement exports rose 45 per cent YoY to 1.76Mt in February, according to the latest data from the Vietnam National Cement Association. Of that total, exports to the USA accounted for 25 per cent, making it the second most important market after the Philippines.

Cement producers from other key suppliers to the USA are somewhat less exposed. Algeria is facing a 30 per cent tariff which will certainly curtail imports but should not dramatically impact Algerian cement production, as exports to the USA account for just four per cent of total production. Similarly, Spain which as a member of the European Union is due to see 20 per cent tariffs, exports just three per cent of the country’s total cement produced.

While Turkey accounted for the most cement imports into the USA in 2024, at 5.7Mt, it is set to face the lowest base tariff of 10 per cent, which is due to take effect from 5 April. Turkey cement exports to the USA account for seven per cent of total domestic cement production.

Both the United Arab Emirates and Colombia, also in the top 10 of cement suppliers to the USA, see six per cent of their domestically produced cement sent to the USA. However, they too face the lowest tariff rate of 10 per cent.

Meanwhile, Mexico, which was the fifth largest supplier of cement to the US in 2024, at just under 1Mt and one of the original targets of the US administration's tariffs, sees cement exports to the US accounting for just two per cent of the country’s total cement production. Hence, the 25 per cent tariff will curtail exporting activity but should not dramatically hit Mexican cement production.

Likewise, while South Korean cement imports are facing a 25 per cent tariff, the industry exports just one per cent of the cement it produces to the US.