By Frank O. Brannvoll, Brannvoll ApS, Denmark

Oil prices support the full energy complex and OPEC+ announced new production cuts totalling 1.6mb/d. Oil prices have risen from US$72/bbl to a high US$88/bbl but are now in their former range of US$80-90/bbl at US$81/bbl.

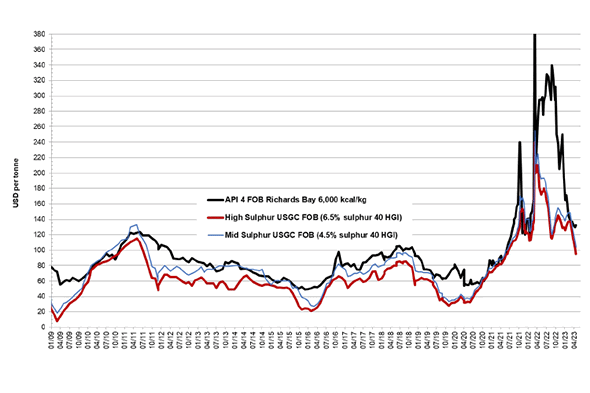

Coal prices are finding support among strong supply and are stabilising at US$132 for the API4 contract.

As expected, petcoke prices have fallen sharply below US$100, the first time since 2021, with discounts compared to coal returning to neutral following an ample supply. The 6.5 per cent S petcoke FOB contract sells at US$95 with an expected range of US$85-105. Resistance is reported at US$105, US$115, US$135, US$155 and US$180. Support is found at US$90, US$85 and US$75 while multi-year support is at US$36.

Steam coal and petcoke prices FOB - historical view 2009-23

The discount for 6.5 per cent S petcoke FOB sold at US$95 is at 37 per cent when compared with API4 coal sold at US$132 in the 3Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$116.50 is at a discount of 28 per cent, when compared with API2 coal sold at US$128 in the 3Q23.

Freight rates continue to increase with the USGC ARA rate at US$21.50.