By Frank O. Brannvoll, Brannvoll ApS, Denmark

The markets are still dominated by hawkish statements from central banks due to the stubbornly high inflation both in the USA and Europe. Expectations see rates climb still higher and for a longer period. However, the good news is that a recession may be avoided.

In the energy markets, the G7 round of new sanctions on Russian refined products do not seem to have had any major impact. The markets are locked between the China reopening and the fear of the impact from higher interest rates. In addition, the terrible earthquakes in Turkey and Syria will have a short-term regional impact on demand. The front in Ukraine continues to be frozen and this increases the need for a settlement as casualties on both sides are running high.

The euro fell back from US$1.10 as forecast and remains in the US$1.05-1.10 range. Brannvoll warns of weakness in the Turkish lira if it moves above TRY19.00.

For 2023 Brannvoll ApS expects the euro to stay within a range of US$0.90-1.10, with an average of US$1.02.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$82.50 | |

| Coal API2 |

2Q23 | US$120.00 |

| Cal 2024 |

US$128.00 | |

| Coal API4 |

2Q23 | US$127.00 |

| Cal 2024 |

US$138.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$135.00 |

| 4.5% CFR ARA |

US$156.50 | |

| 6.5% 40HGI FOB | US$125.00 | |

| 6.5% CFR ARA | US$146.50 | |

Oil and gas

The oil price is trapped in a tight range of US$80-88 and expected to remain in this band in the coming month. A rumour that the UAE would leave the OPEC+ alliance has been dismissed. However, the Taiwan issue between China and the USA is still simmering in the geopolitical background.

In the US the lower oil price has seen a falling oil rigs count and stock building to one-year highs. Moreover, the lack of news from OPEC+ has kept the market gyrating in a 10 per cent range with trading setting the trend.

The geopolitical news is also leading to topside risks. TTF gas in Europe has fallen below EUR50 after having reached EUR300 which should be seen in inflation numbers and power prices.

For 2023 Brannvoll ApS expects the oil price to move within a range of US$80-115/bbl, with an average of US$98/bbl.

Coal

Coal prices continued their dramatic fall from last month and are now also being pressured by declining gas prices and the seasonal drop in demand, as well as most suppliers running smoothly.

Australia has exported more than 2Mt to China, breaking the ban. This is seen as a response to the mining accident that shut down 1Mt of production and sharply-falling Newcastle prices. India has seen coal demand surpassing 1bnt in 2023 and is increasingly the main importer of Russian coal. Russia has continued to offer coal below market prices due to sanctions but with the low price levels, this discount is shrinking rapidly. At the current coal price levels, buyers are advised to compare budget rates and look for buying opportunities.

The API2 front-quarter (2Q23) contract fell by 15 per cent MoM to US$120. The API2 Cal24 contract fell 15 per cent MoM at US$128. For 2023 Brannvoll ApS now adjusts the range down to US$120-220 with an average of US$170 for the quarterly and calendar year API2 contracts.

The API4 front-quarter (2Q23) contract fell by 15 per cent MoM to US$127. Brannvoll ApS forecasts a lower range of US$120-220 with an average of US$170 in 2023. The API4 Cal23 contract fell 17 per cent MoM to US$138. For 2023 the price is revised down to range between US$125-225 with an average of US$175.

Petcoke

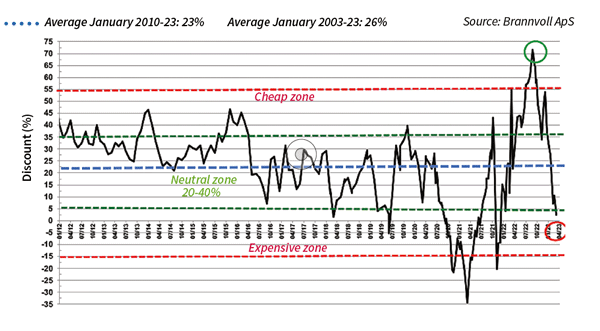

Petcoke prices finally had to give in to pressure from collapsing coal prices, and the discounts have fallen to very expensive zones.

In addition, higher freight prices took support away from petcoke as well as an increasing fuel switch in India, China and Turkey towards Russian coal now also forces prices down as supply has increased lately. Venezuelan export continues and a new record of 3.2Mt was seen in 2022.

With high stocks, China has been seen less in the market, while the earthquake in Turkey also in the short-term lowered demand. On destinations the discount has turned into a premium, forcing petcoke producers to offer at lower prices.

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: March 2023: -4%

The USGC FOB 6.5 per cent sulphur (S) contract is down eight per cent MoM to US$125, with the discount to API4 dropping from 25 to 21 per cent. The USGC CFR ARA 6.5 per cent contract fell by five per cent MoM to US$146.50, as freight rates rose US$5 to US$21.50 and the discount dropping to two per cent and now in the expensive zone. The USGC FOB 4.5 per cent S contract fell seven per cent MoM at US$135, with the discount to API4 down to 15 per cent. The CFR ARA 4.5 per cent contract fell by 5.5 per cent MoM to US$156.50 with the discount turning negative on a premium of 4.3 per cent toward API2, not seen since the 4Q21. Petcoke is expected to fall further towards US$115 and US$125, respectively.