By Frank O. Brannvoll, Brannvoll ApS, Denmark

The markets are still caught in the fear that higher interest rates to fight inflation could start a recession and see demand fall. The market expects both the US Federal Reserve and European Central Bank to increase rates but at a slower rate to enable current levels to take effect. The US debt ceiling agreement reduced market fears and saw equities rise. Geopolitical tensions are looking towards Taiwan where US and Chinese navies are conducting war games, while in Ukraine no progress has been made.

The euro-US dollar exchange rate has stabilised at 1.07-1.12. In 2023 Brannvoll ApS forecasts a range of US$0.95-1.15, with an average of US$1.07.

|

Prices at a glance |

||

|

Crude oil (US$/bbl) |

77.00 |

|

|

Coal |

API2 – 3Q23 (US$) |

105.00 |

|

API2 – Cal 2024 (US$) |

108.00 |

|

|

API4 – 3Q23 (US$) |

106.00 |

|

|

API4 – Cal 2024 (US$) |

105.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

80.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

98.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

69.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

87.00 |

Oil and gas

OPEC+ again showed decisive action at its June meeting, as oil had fallen to US$72/bbl despite April cuts. Saudi Arabia announced a cut of 1mb/d and other members could follow. The current agreement was extended by one year to the end of 2024, signalling that OPEC+ will continue to act as “central bank” to support prices. Brent oil rose to a current US$77, pulling the energy complex gas and coal higher as well.

TTF gas in Europe has dropped further, reaching EUR25/MWh – almost pre-war levels and has been seen pushing coal sharply lower. High inventories and low demand are key reasons. However, Europe may see that LNG now looks towards Asia where higher prices are found. For 2023 Brannvoll ApS forecasts oil price to range between US$75-110/bbl, with an average of US$88.

Coal

Coal prices fell to a two-year low spot, touching US$85, pressured by lower gas and oil prices, but recovered after OPEC+ decisions. Supply is plenty and China has increased its production. However, it has seen lower coal demand on the back of a weak property market, spilling over into lower demand for building materials. This drop in coal demand has led to sharply lower domestic prices. Moreover, Colombia and South Africa have pushed market prices even below some Russian exporters, pressuring the market further down. Stocks in ARA are full and some power producers are now exporting their coal as demand has dropped due to lower gas prices. Brannvoll still recommends looking at budget rates for 2023 and the current forward rates for partial hedging of risks. Also, Australian coal has fallen in competition with Chinese domestic prices.

The API2 front-quarter (FQ) contract of the 3Q23 fell by 14 per cent MoM to US$105, with a short-term range of US$95-125 expected. The API2 Cal24 contract dropped 15 per cent MoM at US$108. For 2023 Brannvoll ApS forecasts a range of US$100-220 with an average of US$150 for quarterly and calendar year API2 contracts.

The API4 FQ contract fell 10 per cent MoM to US$106, with a short-term range of US$100-125. The API4 Cal23 contract fell 17 per cent MoM to US$105. Brannvoll ApS forecasts a range US$100-220 with an average of US$150 in 2023.

Petcoke

The petcoke market has been seeing very wide spreads. Pressured by coal and a lack of petcoke demand has sent petcoke prices tumbling to 2020 levels. Demand from major importers has stalled due to high stocks in China, with supply having increased for months. Turkish buyers may create extra demand as they return to the market following the elections and increase cement demand due to earthquake rehabilitation projects. Following increased discounts, Indian cement producers are slowly turning to petcoke. Moreover, after developments in recent weeks, petcoke is also outpricing Russian discounted coal. Venezuela has been less aggressive due to the low levels set by US refiners, who need to sell petcoke to comply with environmental legislation.

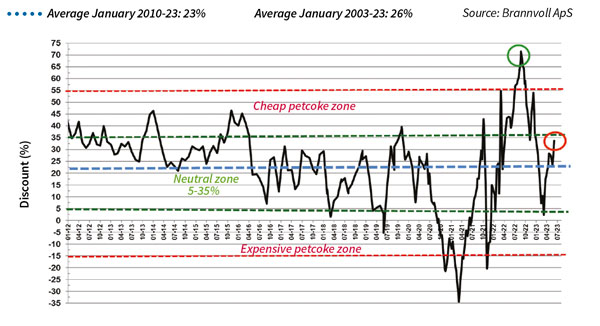

Petcoke discount to coal – API2 USGC 6.5% ARA based on 6000kal: June 2023 – 34%

Taking into account these demand levels, increasing oil and gas prices as well as stabilising coal prices, it may be time to look for petcoke offers. The market may fall a bit further as there is still an overhang. Discounts are currently near the cheap zone.

The USGC FOB 6.5 per cent sulphur (S) contract is down 23 per cent MoM to US$69, with the discount to API4 rising from 42 to 45 per cent The USGC CFR ARA 6.5 per cent S contract fell by 21 per cent MoM to US$87, and the discount up from 28 to 34 per cent, The USGC FOB 4.5 per cent S contract was down 19 per cent MoM at US$80, with the discount to API4 up to 39 per cent. The CFR ARA 4.5 per cent contract declined by 18 per cent MoM to US$98 with the discount rising to 25 per cent.