by Frank O. Brannvoll, Brannvoll ApS, Denmark

Oil is stabilising following an intervention from Saudi Arabia with cuts as negative sentiment persists.

Coal has settled above US$100, but plenty of supply to the market. Nevertheless, a higher price is expected.

Petcoke dropped to US$65, but after 17 weeks, it is now seen as the cheapest fuel and price is moving up. While the discount remains in neutral, its position at the high end points to a move to the cheap zone.

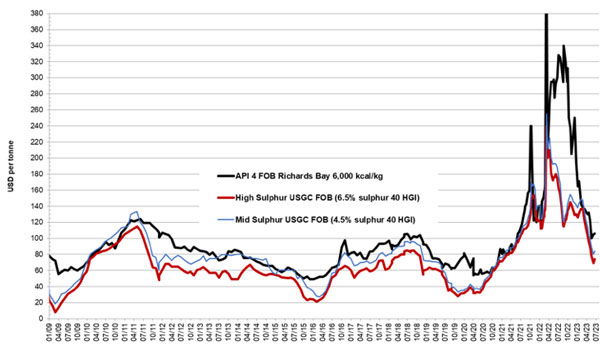

Steam coal and petcoke prices FOB – historical view 2009-23

The discount for 6.5 per cent S petcoke FOB sold at US$74 is at 44 per cent when compared with API4 coal sold at US$106 in the 3Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$89 is at a discount of 36 per cent, when compared with API2 coal sold at US$111 in the 3Q23.

The increase in latest increase in petcoke can create a small rush to secure cargoes as a fear of missing out exists in terms of competitors. Freight rates are sharply lower with USGC - ARA at approximately US$15.