By Frank O. Brannvoll, Brannvoll ApS, Denmark

The holiday mood has dampened the volatility in most markets and the dominant factor is the fear of low demand due to slower growth as central banks keep raising interest rates to bring inflation down. The European Central Bank (ECB) raised interest rates again. Following the general elections, the Turkish Central Bank raised rates by 6.5 per cent to 15 per cent in a new inflation focus.

Talks between the USA and China have released the tension, while the war in Ukraine is still characterised by the same frontlines and gives no inputs to the markets. The VIX index is well below 20, indicating the markets are not worried.

The euro-US dollar exchange rate remains in the US$1.07-1.12 range. Brannvoll ApS forecasts a range of US$0.95-1.15, with an average of US$1.07 in 2023.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$78.00 | |

| Coal API2 |

3Q23 | US$115.00 |

| Cal 2024 |

US$119.00 | |

| Coal API4 |

3Q23 | US$106.50 |

| Cal 2024 |

US$108.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$86.00 |

| 4.5% CFR ARA |

US$101.50 | |

| 6.5% 40HGI FOB | US$77.00 | |

| 6.5% CFR ARA | US$92.50 | |

Oil and gas

OPEC reacted again in July as oil was drifting lower towards US$73, based on lack of demand from China, where weak property markets are dampening activities. Saudi Arabia prolongs the 1mb/d cut into August and Russia will reduce its output by 0.5mb/d. These steps have seen prices lift by five per cent towards US$78.

In addition, US oil stocks were lower and several reports predict a shortage in 2024. However, a Reuters poll forecast for 2024 is below US$90.

Brent oil is currently at US$78, stuck in a range of US$75-80. For 2023 Brannvoll ApS forecasts the oil price to range between US$75-110/bbl with an average of US$88/bbl.

TTF gas front-month trades are at EUR33/MWh, EUR8 higher than last month, while the Cal24 contract is at EUR54.

Coal

Coal prices found support as forecast and rallied in the last month, especially the API2 contract. Chinese prices have stabilised on lower levels and demand from Asia is seen rising. EU import has dropped drastically and the bloc was exporting 1.6Mt in May due to high inventories and lower demand.

Turkey increased its import with most volumes delivered from Russia. Russia could sell with a discount based on higher market prices – up to 20 per cent cheaper than prices of Colombian coal. Range trading is expected for the next month in API2 and API4 markets.

The API2 front-quarter (FQ) contract of the 3Q23 rose by 10 per cent MoM to US$115, with a short-term range of US$105-125 expected. The API2 Cal24 contract likewise rose 10 per cent MoM at US$119. For 2023 Brannvoll ApS forecasts a range of US$100-220 with an average of US$150 for quarterly and calendar year API2 contracts.

The API4 FQ contract was almost unchanged and up 0.5 per cent MoM to US$106.50, with a short-term range of US$105-125. The API4 Cal23 contract rose three per cent MoM to US$105. Brannvoll ApS forecasts a range US$100-220 with an average of US$150 in 2023.

Petcoke

Petcoke prices have been increasing, as warned in the previous issue, touching the US$65 support level. As coal started to rise the discount for petcoke became very large – and as spot supply is scarce, buyers from India and Turkey have been looking to secure “cheap petcoke”. Demand from China is still low due to high stocks while the monsoon in India now puts a dampening effect on the cement sector’s demand.

The higher prices have been on a reduction in output in the short-term and it remains to be seen how the market will look in September. However, petcoke remains currently the cheapest fuel and prices could move further upwards by 5-10 per cent if coal does not fall back. Venezuelan exports may come back if prices go higher as at current levels buyers will not take the extra risk with environmental legislation issues of the quality.

Lower freight has been supporting FOB prices. However, weaker Chinese and Turkish currencies have made imports more expensive.

Brannvoll still recommends securing some petcoke on current levels, if below budget rates for the year.

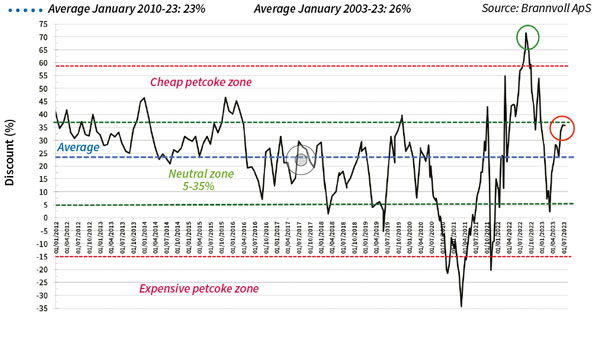

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jul 2023: 36%

The USGC FOB 6.5 per cent sulphur (S) contract is up 12 per cent MoM to US$77, with the discount to API4 falling from 45 to 42 per cent. The USGC CFR ARA 6.5 per cent S contract rose by six per cent MoM to US$92.50, the discount up from 34 to 35 per cent. The USGC FOB 4.5 per cent S contract was up eight per cent MoM at US$86, with the discount to API4 down to 35 per cent. The CFR ARA 4.5 per cent contract rose by four per cent MoM to US$101.5 with the discount rising to 29 per cent.