by Frank O. Brannvoll, Brannvoll ApS, Denmark

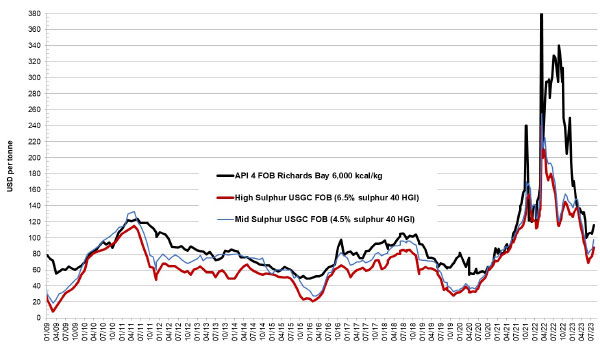

Coal rallied from US$100, driven by the energy complex as oil broke through the US$80 barrier following new cuts by OPEC+ in July 2023.

Meanwhile, petcoke continues its rally after hitting the major support of US$65, and reached its target of US$85. At US$88, is now close to resistance at US$90 with discounts to coal falling sharply into the neutral zone. Further points of resistance are US$95, US$105, US$115 and US$135. Support is at US$85, US$70, US$68 and US$55. As predicted, several bids are now seen in the market as the price trend shifted.

Steam coal and petcoke FOB prices, 2009-23

The discount for 6.5 per cent S petcoke FOB sold at US$88 is at 39 per cent when compared with API4 coal sold at US$116 in the 3Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$115 is at a discount of 26 per cent, when compared with API2 coal sold at US$114 in the 3Q23.

Freight has been moving slightly higher with the USGC-ARA rate now at US$17.