By Frank O. Brannvoll, Brannvoll ApS, Denmark

The fight against inflation is still the focus point for the US Federal Reserve Bank and the European Central Bank, which both raised interest rates by 0.25 per cent in July.

This impacted equity markets as the IMF came out with a slower global GDP forecast for 2024, down 0.5 per cent to three per cent. However, new Chinese promises of boosting the economy have taken some of the fear out of the energy markets, which have seen a recovery in the last weeks.

Some hints of peace talks are emerging from Ukraine as the frontline remains almost unchanged. The meeting currently taking place in Saudi Arabia could start a peace process with a plan, if agreed, supporting markets substantially.

The euro-US dollar exchange rate still trades in a US$1.07-1.12 range. Brannvoll ApS forecasts a range of US$0.95-1.15, with an average of US$1.07 in 2023.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$85.50 | |

| Coal API2 |

4Q23 | US$114.00 |

| Cal 2024 |

US$121.00 | |

| Coal API4 |

4Q23 | US$112.00 |

| Cal 2024 |

US117.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$100.00 |

| 4.5% CFR ARA |

US$115.50 | |

| 6.5% 40HGI FOB | US$90.00 | |

| 6.5% CFR ARA | US$105.50 | |

Oil and gas

OPEC+ has succeeded in changing the course of the oil price. Saudi Arabia and Russia have prolonged their unilateral cuts to at least September and declared the OPEC+ could cut more if needed to defend a US$80 price level.

Speculative buying has now occurred and several analysts have upgraded their forecasts. Some tensions have been seen as Russian oil is now priced above the US$65 price level proposed by the G7. However, Russian exports seem unharmed in their new markets. Geopolitics remains the biggest joker.

Brent oil has risen 10 per cent and has entered a new higher range of US$80-90, trading at US$83.

For 2023 Brannvoll ApS forecasts a trading range between US$75-110/bbl with an average of US$88/bbl.

TTF gas front-month trades have fallen 10 per cent to EUR29.50/MWh and likewise, the Cal24 contract has slipped lower at EUR49.

Coal

Coal prices remain steady on the higher levels as expected and is now supported by the higher oil prices. Coal demand stands at an all-time high of 8.3bnt, according to a new report by the EIA. India and China account for 70 per cent of the total. The EU and USA account for a combined eight per cent. In terms of demand growth, Chinese demand is up five per cent, India up eight per cent while US consumption is down seven per cent. However, production has also increased, primarily in India and China as well as Indonesia, but in Russia output remains unchanged. The level of ~US$100 for Cal2024 appears like a major support.

The API2 front-quarter (FQ) contract of the 4Q23 fell by one per cent MoM to US$114, still with an expected short-term range of US$110-125. The API2 Cal24 contract rose 1.5 per cent MoM to US$121. For 2023 Brannvoll ApS forecasts a range of US$100-220 with an average of US$150 for quarterly and calendar year API2 contracts.

The API4 FQ contract increased by five per cent MoM to US$112 with a short-term range of US$105-125. The API4 Cal24 contract rose 11 per cent MoM to US$117. Brannvoll ApS forecasts a range of US$100-220 with an average of US$150 in 2023.

Petcoke

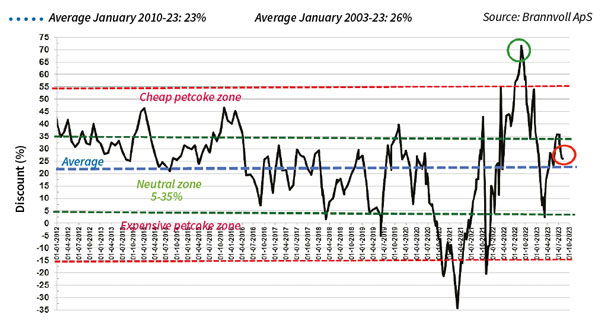

The rally in the petcoke market continued as forecast. Output has been lower and a sudden export stop from Venezuela due to low prices caught the markets by surprise. However, Venezuela is expected to resume exports soon. With coal prices rising, traders raised their petcoke offer prices as well and due to low volumes in the market, buyers started to hunt around for lower prices. The discount offered by petcoke in comparison to coal has fallen considerably and is now in the lower end of the neutral zone.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Aug 2023: 26%

Weather-related causes have kept Chinese demand low, while India is emerging from its monsoon pause with an expected pick-up of demand. In the US several refineries are planning to use heavier crude, resulting in an increased petcoke supply. In Turkey Russian coal, with its large discount, is still seen as its biggest competitor. Lower freight still supports FOB prices.

Unlike in the previous two months, Brannvoll no longer recommends aggressive buying as the discount is in the neutral zone.

The USGC FOB 6.5 per cent sulphur (S) contract rallied 16 per cent MoM to US$90, with the discount to API4 falling to 36 per cent. The USGC CFR ARA 6.5 per cent S contract rose by 14 per cent MoM to US$105.50. The discount is collapsing to just 26 per cent.

The USGC FOB 4.5 per cent S contract is up 16 per cent MoM hitting US$100, with the discount to API4 down to 29 per cent. The CFR ARA 4.5 per cent contract rose by 14 per cent MoM to US$115.50 with the discount down to just 17 per cent.