Cement demand in Switzerland, including Liechtenstein, declined eight per cent to 786,433.2t in the first quarter of 2024 when compared with 855,143.7t in the 1Q23, according to the Swiss cement association, cemsuisse. While cement sales continue to fall due to uncertainty in terms of interest rates, energy prices and supply chains, the decline is slowing. Planned projects in civil engineering, which are expected to stabilise the market, remain positive.

Low-carbon cement accounts for 96.5 per cent of total sales – a share that has remained stable when compared with the equivalent period of the previous year.

Of total deliveries, 761,990t, or 96.9 per cent, is supplied in bulk while bagged cement accounts for 24,442.8t (3.1 per cent).

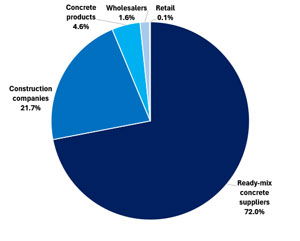

Swiss cement sales by market segment, 1Q24

In terms of market segments, sales to the ready-mix concrete sector declined to 566,094.9t in the 1Q24 from 630,148.2t in the 1Q23. Construction companies accounted for 171,045.8t in the 1Q24, down from 169,278.3t in the 1Q23. The concrete products segment required 36,302.6t of deliveries in the 1Q24, down from 41,486.1t in the 1Q23. Approximately 12,223.9t was supplied to the wholesale segment, up from 12,964.2t in the 1Q23 while sales to the retail sales dropped to 766t from 1267t.

Rail transport of cement has increased its share to 38.2 per cent YoY from 37.1 per cent, but the majority of deliveries are transported by road.

Outlook

The outlook for Swiss cement is for a modest improvement in 2024. The economy is forecast to grow 1.3 per cent YoY this year, up from 0.8 per cent YoY in 2023, according to the International Monetary Fund.

Construction is expected to recover slowly after a difficult 2023. Property prices rose 2.2 per cent YoY, down from 6.4 per cent YoY in 2022. Cooling inflationary pressures and a recent reduction in interest rates will help purchasing power.

Ongoing urbanisation and large infrastructure projects will be key bolsters to cement demand. The government has earmarked CHF11.9bn (US$13bn) for the development of transportation infrastructure in 2024.

Weaknesses in Germany and France suggest export demand will fail to support Swiss cement producers. Spillover effects from problems in neighbouring countries are a downside risks for the Swiss economy.