By Frank O. Brannvoll, Brannvoll ApS, Denmark

The major equity market decline at the start of August, initiated by an interest rate increase to 0.25 per cent by the Bank of Japan, and followed by weak US employment numbers, suddenly turned the markets into fear of recession. The US Federal Reserve’s (Fed) indication that it will lower interest rates from September was suddenly seen as negative. It seems the market has forgotten that the Fed’s successful strategy to fight inflation is no longer required. Therefore, the reaction by the equity market seems excessive.

The Middle Eastern political situation has worsened as Israel edges very close to confrontations with Hezbollah after several attacks on northern Israel. In the Ukraine-Russia war, rumours of a possible peace are circulating, pressured by political realities. Meanwhile, US President Joe Biden has withdrawn his bid for a second term for Kamala Harris to be the Democrat nominee, instantly closing the lead of Donald Trump and indicating a very close run.

The euro has risen to US$1.10, at the top of the US$1.06-1.11 range. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance - 5 August 2024 |

||

|

Crude oil (US$/bbl) |

78.60 |

|

|

Coal |

API2 – 4Q24 (US$) |

121.00 |

|

API2 – Cal 2025 (US$) |

122.00 |

|

|

API4 – 4Q24 (US$) |

116.00 |

|

|

API4 – Cal 2025 (US$) |

119.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

65.00 |

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

90.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

61.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

86.00 |

|

Oil

The flare-up of Israel-Hezbollah tensions can normally be expected to support oil. However, following the fear of recession, concerns about low demand resulted in Brent oil falling below the major support of US$78 and US$80 in time of writing. This adds to an already weak market following OPEC+’s intention to reduce cuts in October, offering more oil. However, if the oil price falls below US$80, this reduction of cuts may be delayed.

Despite political unrest following the presidential elections in Venezuela and US sanctions remaining in place, Venezuela has maintained a high oil production level. Furthermore, higher US output in July has also increased global oil supply.

Brent oil has fallen 11 per cent to US$76.80, with major support now at US$75 and a new short-term range of US$75-85, in case of a Middle East escalation. Brannvoll ApS maintains a trading range of US$70-100, with an average of US$90 for 2024.

Coal

The coal market went against the overall energy complex and saw moderately higher prices based on increased Indian and Turkish demand. The Russian discount was also lower during July, adding slight upwards pressure as the export volume slipped. Poor railway performance in South Africa continued to impact the local coal supply to the ports, while in Colombia tribal protests stopped exports from the Cerrejon line. China had large stocks in ports and its 405Mt domestic production was at a record high since 2019.

The front-quarter (FQ) contract changed from 3Q24 to 4Q24, which is higher due to the winter season. The API2 FQ contract rose by 13 per cent MoM to US$121, with a new short-term range of US$110-128. The Cal25 contract rose by seven per cent to US$122. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract rose by eight per cent to US$116, still in the short-term range of US$100-120. The Cal25 contract was up by five per cent to US$119. Brannvoll ApS forecasts the range to US$100-135 in 2024.

Petcoke

The petcoke market was again seen lower, with the potential ban from China and the undisclosed timing of its implementation hanging as a shadow over the Chinese market, with buyers taking advantage and lowering offers in the high sulphur market.

Venezuelan cargoes are still around in the 4.5 per cent market, putting pressure on prices, especially as freight is going higher. Millions of tonnes of petcoke are waiting to be sold, but US sanctions keep several cement buyers away.

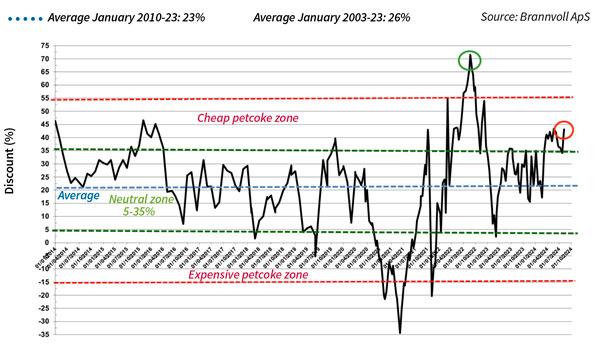

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jul 2024: 36%

The rising coal and falling petcoke prices have widened the discount, returning it to the cheap zone. While petcoke still offers a good discount, it is now in the low range of the cheap zone both for FOB and even ARA (see Figure 1). The UGC FOB 6.5 per cent sulphur (S) contract fell three per cent MoM to US$61 and the discount to API4 was higher at 58 per cent. The USGC ARA 6.5 per cent S contract edged up one per cent MoM to US$86. On account of higher coal, the discount was up to 43 per cent.

The USGC FOB 4.5 per cent S contract fell seven per cent MoM to US$65, with the FOB discount to API4 rising to 55 per cent. The CFR ARA 4.5 per cent contract rose one per cent to US$90 due to higher freight rates with the discount continuing to rise to 40 per cent.

The spread between 6.5 and 4.5 per cent S contracts is down to US$5 and seen in a US$4-8 range.