Energy markets are still awaiting the initial actions of US President Elect Donald Trump. In particular, policies on tariffs are expected to have huge impact on demand and trade, as well as on freight prices. A trade war could drive up inflation and disrupt efforts by central banks to lower interest rates. However, the ECB is expected to look at stimulating growth in the eurozone while proceeding with its plan to lower interest rates.

Geopolitically, the impact from a ceasefire or peace talks in Ukraine will depend on sanctions and the flow of gas and gas from Russia. Elsewhere, the Syrian regime change opens up new possibilities for reconstruction and cement demand, with a currently positive outlook.

In terms of trading, the markets have been in holiday mode and no large swings were observed in December or January, except in the carbon market. No significant changes are expected until 20 January 2025.

The US dollar continued to strengthen in the US$ index and the euro, testing the major support of US$1.0350 with a range of US$1.03-1.06 expected. Brannvoll ApS expects the short-term exchange rate down to US$1.0200 and a range of US$1.05-1.15, with an average of US$1.12 in 2025.

| PRICES AT A GLANCE - 7 January 2025 |

||

| Brent crude oil – bbl | US$76.50 | |

| Coal API 2 | 1Q25 | US$107.00 |

| Cal 2025 | US$109.00 | |

| Coal API 4 | 1Q25 | US$103.00 |

| Cal 2025 | US$107.00 | |

| Petcoke USGC 4.5 per cent S 40HGI | FOB | US$70.00 |

| CFR ARA | US$89.00 | |

| Petcoke USGC 6.5 per cent S 40HGI | FOB | US$65.00 |

| CFR ARA | US$84.00 | |

Oil

Oil was trading slightly higher than December due to a potential fall in supply from Iran, Venezuela and continued cuts from OPEC+. However, the question of tariffs is hanging over the markets. If prices are lifted between 25-60 per cent due to tariffs, demand could be impacted.

In one of his last decrees, US President Biden has banned oil drilling in coastal areas to hinder a rapid expansion after the regime change.OPEC+ is still defending a price of US$70 and a fight for market share could lead to massive falls towards US$50-60 for Brent oil.

TTF gas prices were higher due to the closed transit via Ukraine to Slovakia, Czechia and Austria of Gazprom deliveries, as well as colder weather.

Brent oil traded higher at US$76.50, seen in a range of US$72-79. However, Brannvoll ApS forecasts a trading range of US$65-90 and average of US$75 for 2025.

Coal

The coal market continued to fall despite the price rise in the EU gas sector. Production in China and India is expected to increase in 2025. However, the markets in these countries also await Trump’s take on tariffs. In addition, Chinese ports are seeing large stocks, leading to lower imports. Russian coal has seen slightly less railway capacity, but demand also fell in December.

The API2 1Q25 (front-quarter – FQ) contract fell (again) by four per cent MoM to US$107 with a short-term range of US$105-115. The Cal26 contract continued to slip, by five per cent, to US$109. Brannvoll forecasts a range of US$100-130 and an average of US$125 for the 1Q25 contract.

The API4 FQ contract fell eight per cent to US$103, maintaining the short-term range of US$100-120. The Cal26 contract was down four per cent to US$107. Brannvoll ApS forecasts a range of US$100-130 in 2025.

Petcoke

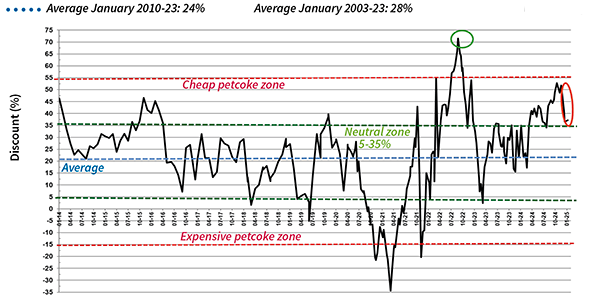

The petcoke market continues its expansion, as the discount still lures buyers in. However, December was very quiet and almost no liquidity was seen. The assessment takes into consideration lower coal prices and continued good demand. However, India has seen lower demand due to high domestic production and China imported only small volumes from USGC. India and China counteracted Trump’s introduction of tariffs during his last presidency by adding tariffs of their own on petcoke. China has still not provided any clarification regarding its position on banning high-sulphur petcoke.

In the medium term, the new political situation in Syria could be an opportunity for Turkish cement producers to play an active role in the rebuilding of the country’s infrastructure. This could lead to higher demand for petcoke.

Lower freight rates also support the petcoke prices in the short term.

The UGC FOB 6.5 per cent sulphur (S) contract was up by three per cent MoM to US$65 and the discount to API4 fell from 54 to 50 per cent. The USGC ARA 6.5 per cent S contract rose two per cent MoM to US$84 MoM with the discount falling from 41 to 37 per cent.

The USGC FOB 4.5 per cent S contract rose by one per cent MoM to US$70, with the FOB discount to API4 falling to 46 per cent. The CFR ARA 4.5 per cent contract rose 0.5 per cent to US$89.

The spread between 6.5 and 4.5 per cent S contracts declined to US$5, moving within a US$ 4-8 range.

by Frank O. Brannvoll, Brannvoll ApS, Denmark