By Frank O. Brannvoll, Brannvoll ApS, Denmark

Geopolitics still dominate the markets. Financial markets expect the US Federal Reserve to deliver a 0.25 per cent cut in mid-September and a further 0.25 per cent before the US presidential elections. This could be followed by the European Central Bank and seen as the trend for 2025. The focus remains on inflation, which now is falling in both US and EU. Meanwhile, in the Middle East tension has somewhat calmed, however, high levels of tension persist in northern Israel and Hezbollah areas. The war in Ukraine could be moving towards talks in the run-up to the US elections as the frontlines are in motion now.

The euro has stabilised at higher levels and is now at US$1.105, at the top of the US$1.06-1.11 range. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance - 9 September 2024 |

||

|

Brent crude oil (US$/bbl) |

71.80 |

|

|

Coal |

API2 – 3Q24 (US$) |

115.00 |

|

API2 – Cal 2025 (US$) |

119.00 |

|

|

API4 – 3Q24 (US$) |

110.00 |

|

|

API4 – Cal 2025 (US$) |

115.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

63.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

86.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

57.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

80.00 |

Oil

OPEC+ had expected to increase its production in October, but due to the weakness of the Brent oil, which reached US$71 in early September, the action has been delayed by at least two months. This delay could continue if the oil price does not recover towards the range of US$75-85. In Libya political tensions have brought oil exports to a hold, but this has not supported prices to date. Slower economic growth in China has resulted in weaker domestic demand, leading to less support for oil prices. US oil production is still high and increased Canadian supply to the market has also been adding to a supply glut, resulting in the low prices.

Brent oil has fallen seven per cent to US$71.80 and has lowered the trading range to US$70-80 below the previous range of US$75-85. Major support is now at US$70. If this were broken with a downside towards US$65, Brannvoll ApS maintains a trading range of US$70-100, but lowers the US$80 average for 2024.

Coal

The coal market was resilient but followed oil a bit lower, as gas prices also moved lower with oil. Lower demand has kicked in, but restocking for the winter is seen as support. Coal was close to the top of the expected trading range and increased Chinese domestic production has lowered exports. US export increased as the repair following port accidents has been finalised. Russia and Colombia have been competing in the Turkish market for market share, also adding pressure to prices. South Africa has seen fall in demand. Australia saw an increase from Japan and went against the overall direction. Increased competition from petcoke, especially in the cement sector, is expected over the next few months.

The API2 FQ4 contract fell by five per cent MoM to US$115 with a short-term range of US$110-125. The Cal25 contract declined just 2.5 per cent to US$119. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract decreased five per cent to US$110, hovering in the short-term range of US$100-120. The Cal25 contract was down by two per cent to US$119. Brannvoll ApS forecasts a range of US$100-135 in 2024.

Petcoke

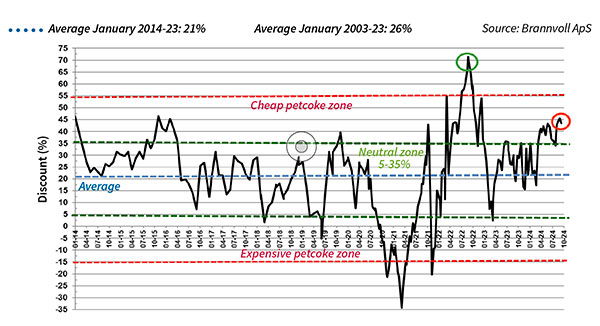

Breaking below the major support US$60 for years in the high sulphur petcoke market has sent the discount into the cheap zone.

The combination of a lower energy complex, lack of demand from China, heavier and longer rainfalls in India and bidders taking advantage of traders being long on petcoke have turned the market very negative. The market is still expecting news and clarification from China and remains nervous in the meantime. However, Brannvoll notes that the discount to coal both FOB and ARA is very high, even compared to Russian coal. New supply from the Mexican Gulf and Venezuela still in the mid-sulphur market could result in a lower market in the very short-term.

If oil suddenly rises, the petcoke price could be dragged along as petcoke is now at major support levels at US$59 for the 6.5 per cent sulphur (S) contract. The softer coal but falling petcoke prices have again increased the discount, returning it to the cheap zone not seen since 2022.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Sep 24: 44%

For short-term needs it may be an idea to consider petcoke at these levels as the discount can go lower very fast. The UGC FOB 6.5 per cent (S) contract fell seven per cent MoM to US$57 and the discount to API4 was higher at 59 per cent. The USGC ARA 6.5 per cent S contract fell 2.5 per cent MoM to US$80. The discount was down to 41 per cent, due to lower coal.

The USGC FOB 4.5 per cent S contract slipped three per cent MoM to US$63, with the FOB discount to API4 staying at 54 per cent. The CFR ARA 4.5 per cent contract was lower at US$86, due to higher freight rates with the discount falling to 37 per cent.

The spread between 6.5 and 4.5 per cent S contracts widened to US$6 and was seen in a US$ 4-8 range.