In a market dominated by geopolitical news from the Middle East (Israel–Hezbollah–Gaza) and a new nuclear doctrine from Russia, which puts the next steps in the war in Ukraine in a new perspective, the energy complex has been resilient and moved lower.

However, the US Federal Reserve’s interest rate cut of 0.5 per cent following the 0.25 per cent one by the European Central Bank eased the markets. Furthermore, China published a new stimulus plan and interest cuts, which added support, especially to the oil market. The lower energy prices are part of driving US and eurozone inflation down, paving the way towards the two per cent inflation target.

The US dollar has fallen on a broad scale, and the euro – now above US$1.10 – has stabilised at higher levels at US$1.1150, at the top of the US$1.07-1.12 range. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

Oil

A lower US dollar and geopolitical tensions have maintained some support for the commodity markets. The interest rate cuts combined with China’s stimulus provided some relief, but OPEC is not expected to increase its output due to much lower demand forecasts. In fear of reduced demand and ample supply from non-OPEC members, the oil price has been testing the US$70 level again.

Saudi Arabia may have abandoned its US$100 target, and if OPEC+ decides to go for market share instead of stable price, this could lead to a massive fall towards US$50-60 for Brent oil.

Brent oil remained unchanged at US$71.50 and has lowered the trading range to US$70-80. Major support is now at US$70. If this level is broken with a downside towards US$65, Brannvoll ApS maintains a trading range of US$70-100 but lowers the average for 2024 to US$75.

Coal

Coal moved higher against the oil trend due to seasonal demand and colder weather. The ARA stocks are at their lowest level for two years and some restocking is taking place. There are offers in the market from South Africa, while Colombia and Russia have competed for market share, putting a lid on prices. China and India are both planning to increase their domestic production considerably over the next few years due to increased power demand from electric vehicles. Indonesia has been increasing its exports.

Coal retracted slightly from the top of the range and there were no real supply problems. The API2 FQ4 contract rose by three per cent MoM to US$118.25 with a short-term range of US$110-125. The Cal25 contract increased 2.5 per cent to US$122. Brannvoll maintains a range of US$100-130 and an average of US$125.

The API4 FQ contract advanced four per cent to US$114.50, hovering in the short-term range of US$100-120. The Cal25 contract was up one per cent to US$120. Brannvoll ApS forecasts a range of US$100-135 in 2024.

Petcoke

The considerable drop in petcoke prices continued during September. The break below US$60 is driven by massive supply from US and other producers. Buyers lowering their bids in anticipation of even lower prices has sent the high sulphur contract to US$50.

The uncertainty of China’s proclaimed ban and a lack of Chinese buyers has put downward pressure on the market. Meanwhile, Venezuela is still offering medium grade material at large discounts.

The nominal prices and the very high discounts are now seeing interest from Indian buyers and an effect can be seen as the first big trades go through.

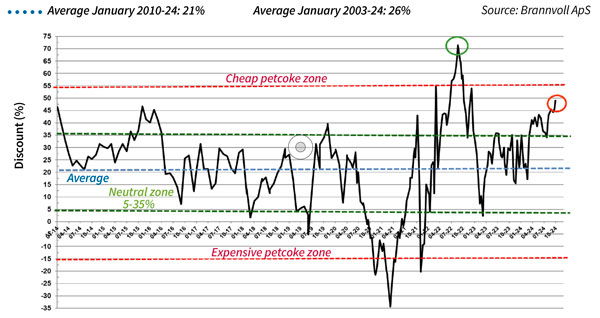

The major support at US$48-50 is expected to hold and a revisit to the long-term trend at US$40 is not expected. Brannvoll reminds readers that the discount to coal FOB and ARA is very high. Due to the slightly higher coal price and the drop in petcoke, petcoke should be considered as the discount can fall very fast.

The UGC FOB 6.5 per cent (S) contract fell 12 per cent MoM to US$50 and the discount to API4 is revisiting higher at 65 per cent (cf all-time high of 73 per cent in 2022). The USGC ARA 6.5 per cent S contract fell 10 per cent MoM to US$75.50. The discount has widened to 49 per cent.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Oct 2024: 49%

The USGC FOB 4.5 per cent S contract slipped 11 per cent MoM to US$56, with the FOB discount to API4 increasing to 61 per cent. The CFR ARA 4.5 per cent contract was nine per cent lower at US$81.50.

The spread between 6.5 and 4.5 per cent S contracts remained at US$6 and is seen in a US$4-8 range.