Coal prices remained steady at around US$110-120, seeking support from oil, which recovered to US$80/bbl but has since slipped to US$75/bbl. Support from OPEC+, along with a US Federal Reserve rate cut, is supporting demand.

Petcoke is under pressure from Chinese ban. As petcoke prices slide, the discount when compared with coal is very high, close to an all-time high. On 22 October 2024 the discount for 6.5 per cent sulphur petcoke FOB sold at US$50 is 66 per cent when compared with API4 coal sold at US$118 in the 4Q24. The CIF ARA 6.5 per cent petcoke contract sold at US$55 is at a discount of 53 per cent when compared with API2 coal sold at US$122 in the 4Q24.

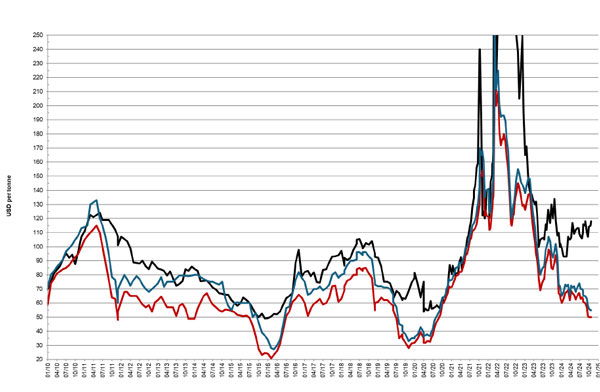

Coal FOB price trend, January 2010-22 October 2024: API 4 Richards Bay 6000kcal/kg (black),

6.5% sulphur USGC 40HGI (red) and 4.5% sulphur USGC 40HGI (blue)

Petcoke with 6.5 per cent S is expected to move within the US$48-58 range with resistance at US$58, US$68, US$75, US$95, US$105 and US$1155. Support is at US$50, US$48 and US$40 with multi-year support at US$40. For 2025 a broad range of US$45-70 is forecast.

Freight prices have softened with the USGC-ARA freight rate currently at US$22.