Following Donald Trump’s win in the US presidential elections the energy markets already reacted on several fronts in anticipation of new US policies. An increase in US production of oil and gas is expected while in the Ukraine-Russia war the focus is expected to shift to ending the conflict and rebuilding the country. These speculations are expected to increase in December and January, based on Mr Trump’s election promises. While the focus on sustainability may persist, it is also expected that definitions of green will be less rigid, enabling the markets to choose from a wider range of options when developing green projects. In terms of the US dollar, this has strengthened slightly and rate cuts will be delayed or reduced. This often moderately lowers commodity prices.

Meanwhile, the ongoing Iran-Israel geopolitical issues still persist as do threat levels on the Red Sea, making freight longer and expensive. Israel is making progress in its northern and southern operations, and the ending of these could also be in focus in January. Hereunder use of Tarifs and if this can turn into a trade war involving all big trading blocs – and impact demand supply flows

The US dollar has strengthened and the euro is now at the low end of the predicted range of US$1.07-1.12. Brannvoll ApS sees a range of US$1.05-1.15, with an average of US$1.12 in 2025.

| PRICES AT A GLANCE - 6 November 2024 | ||

| Brent crude oil – bbl | US$74.80 | |

| Coal API2 | 1Q25 | US$117.00 |

| Cal 2025 | US$119.00 | |

| Coal API4 | 1Q25 | US$114.50 |

| Cal 2025 | US$116.00 | |

| Petcoke | ||

| USGC 4.5 per cent 40HGI | FOB | US$59.00 |

| CFR ARA | US$81.00 | |

| USGC 4.5 per cent 40HGI | FOB | US$53.00 |

| CFR ARA | US$75.00 | |

Oil

A stronger US dollar and the anticipation of increased US oil production in the next few years have kept Brent oil relatively stable between US$72-76 in the last month. OPEC+ is not expected to increase its output, due to much lower demand forecasts. However, an aggressive US increase in production could change this policy, forcing prices lower in a fight for market share. This could lead to massive falls towards US$50-60 for Brent oil.

Brent oil traded higher at US$74.50, between its lower trading range to US$70-80.

Brannvoll ApS forecasts a trading range of US$65-90 and an average of US$75 for 2025.

Coal

There was no major specific coal news in the last month, but following a rally driven up by gas prices in Europe, there is now a slow decline within its trading range. Coal is expected to see a revival during the Trump administration.

Meanwhile, high stocks and increased outputs are keeping a lid on prices. Increased possibilities for railing of Russian coal could also add more volumes to the market.

The API2 1Q25 (front-quarter) contract fell by one per cent MoM to US$117 with a short-term range of US$110-125. The Cal25 contract slipped by 2.5 per cent to US$119. Brannvoll forecasts a range of US$100-130 and an average of US$125 for the 1Q25 contract.

The API4 front-quarter contract fell two per cent to US$114.50, maintaining the short-term range of US$100-120. The Cal25 contract was down three per cent to US$116. Brannvoll ApS forecasts a range of US$100-30 in 2025.

Petcoke

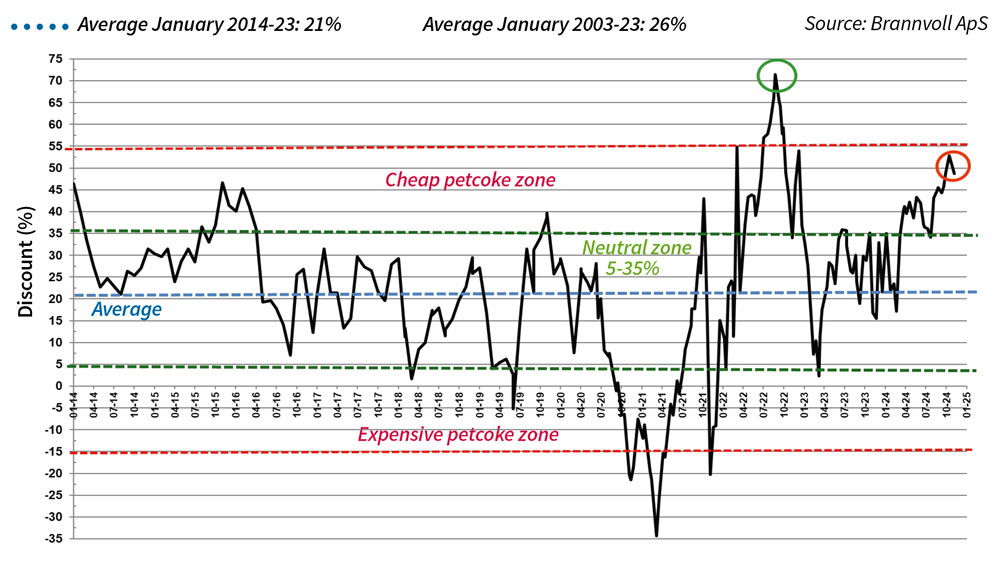

Petcoke prices seems to have bottomed out just below the US$50. The massive discounts offered by petcoke has seen buyers from China, India and Türkiye returning to the market.

In addition, the Chinese potential ban appears to be delayed until 2025 and buyers have been seen in the higher sulphur market again. However, end-of-year reductions of stocks may postpone purchases, but the long-term support levels of prices were almost reached, indicating a big opportunity.

The USGC FOB 6.5 per cent sulphur (S) contract rose – for the first time in months – by six per cent MoM to US$53 and the discount to API4 was lower at 62 per cent, significantly below the all-time high of 73 per cent in 2022. The USGC ARA 6.5 per cent S contract remained almost unchanged MoM at US$75 with the discount stable at 49 per cent.

The USGC FOB 4.5 per cent S contract advanced by 5.5 per cent MoM to US$59, with the FOB discount to API4 falling to 59 per cent. The CFR ARA 4.5 per cent contract was unchanged at US$81.

The spread between 6.5 and 4.5 per cent S contracts remained at US$6 and is seen in a US$ 4-8 range.