By Frank O. Brannvoll, Brannvoll ApS, Denmark

The euro rose sharply from US$1.1150 to US$1.1450 after the European Central Bank hinted that rate hikes were on the way, based on fear of higher inflation numbers. However, while it is expected to remain in the range of US$1.115-1.1600, volatility could arise depending on the geopolitical outcome after tensions increased when Russian troops amassed near the Ukrainian border, favouring a stronger US dollar.

The Turkish lira stabilised between TRY13.25-14.25 against the US dollar despite negative real yields as inflation surged to 35 per cent.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

91.00 |

|

|

Coal |

API2 – 1Q22 (US$) |

155.00 |

|

API2 – Cal 2023 (US$) |

119.00 |

|

|

API4 – 1Q22 (US$) |

151.50 |

|

|

API4 – Cal 2023 (US$) |

115.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

138.50 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

159.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

126.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

147.00 |

Oil and gas

The current geopolitical tensions fully dominate the energy complex, adding a risk premium to all fuels, including oil and gas.

OPEC+ is keeping to its current course and did not release more oil than the 0.4mbpd as planned. However, the reality is that due to several OPEC members not producing their quota the market is missing 0.6mbpd. As a result, the oil price reached US$94, a level not seen since 2014. Meanwhile, the US and Iran nuclear talks seem to progress with Iran’s 1.5mbpd production potentially coming to market and setting a lid on prices.

The TTF gas market is rising as tensions are growing with threats from the US and Germany that Nord Stream 2 will be stopped in case of a Russian attack on Ukraine. Russia is still delivering only contractual amounts.

Brent oil is currently at US$91.00, up 11 per cent MoM with resistance at US$94 and US$100. Support is noted at US$88 and US$80 with major support at US$67.

Branvoll ApS forecasts a range of US$60-100 with an average of US$75 in 2022.

Coal

Coal was rising in the front contracts due to the geopolitical tensions and higher gas prices, making coal the cheapest fuel. Stocks in Europe are at six-year lows and problems continue to affect the Russian railway system. Indonesia has lifted its ban on coal exports but added 19 per cent to export prices.

In China prices rose due to reduced production in the New Year and reached CNY1100 (US$150), above the NDRC target of CNY1000. A return to production and lower consumption during the Olympic Games as industries around Beijing have curbed production to pollute less should see less pressure.

In terms of coal contracts, API2 front-quarter (2Q22) increased 17 per cent MoM to US$155 with resistance at US$160 and US$180. Support was at US$150 and US$125. A range of US$135-170 is expected. The API2 new front-year Cal23 contract was up 22 per cent MoM to US$119. Resistance was at US$125 and US$150 while support was found at US$105 and US$90.

The API4 front-quarter (2Q22) contract edged up seven per cent to US$151.Resistance could be found at US$150 and US$160 while support was at US$130 and US$115. A range of US$135-160 is forecast.

The API4 new front-year Cal23 contract saw a 20 per cent hike with resistance at US$116 and US$130, and support at US$110 and US$98.

Petcoke

Petcoke was driven by the rise in coal prices with increasing discounts. Buyers were looking for petcoke and sellers lifted prices due to lower freight rates setting. Trading activity was low due to Chinese New Year and resulted in wide spreads.

In India cement demand is expected to rise as the new fiscal year starts with new infrastructure projects. Trading was very thin with limited deals at the end of the year and big spreads between buyers and sellers.

In Turkey demand increased as the lira stabilised. However, buyers looked at the domestic supply first.

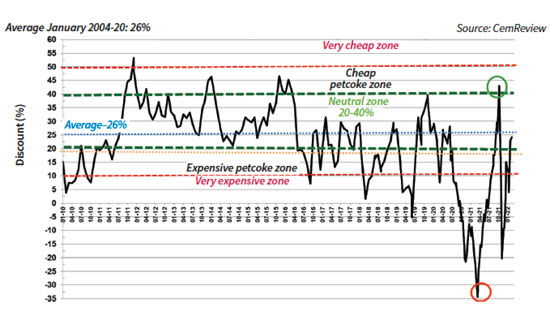

The discounts on FOB and ARA are now back in neutral zones and will likely offer incentive for petcoke purchases in the near future, but upward moves in coal prices will drag petcoke higher as well. Current discounts will keep buyers in the petcoke market. With diesel back in demand, refineries are now running at high capacity utilisation rates.

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Feb 2022: 24%

The USGC FOB 6.5 per cent sulphur contract increased four per cent MoM to US$126, with the discount to API4 advancing from 91 to 33 per cent. A range of US$115-135 is expected. USGC CFR ARA for this type of petcoke remained stable at US$147. The discount to API2 increased to 24 per cent from 11 per cent.

For 4.5 per cent sulphur petcoke the USGC FOB slipped three per cent MoM to US$.138 with the discount to API4 is at 27 per cent, up from 11 per cent. A range of US$130-150 is expected. The CFR ARA contract fell by five per cent to US$159 with lower freight rates bringing the discount back to 18 per cent from -2 per cent.

The spread between 4.5 and 6.5 per cent narrowed to US$12, down from US$21, and a range of US$8-18 is expected.