By Frank O. Brannvoll, Brannvoll ApS, Denmark

Following Russia’s invasion into Ukraine, markets have been experiencing extreme volatility. In less liquid markets, such as petcoke, trade was virtually suspended in the first week after the invasion. Therefore, this report will diverge from its usual format.

|

Table 1: Prices at a glance |

||

|

Crude oil (US$/bbl) |

121.00 |

|

|

Coal |

API2 – 2Q22 (US$) |

390.00 |

|

API2 – Cal 2023 (US$) |

190.00 |

|

|

API4 – 2Q22 (US$) |

370.00 |

|

|

API4 – Cal 2023 (US$) |

180.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

205.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

235.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

190.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

220.00 |

With Europe neighbouring the conflict zone, the euro has been considerably impacted while the US dollar has seen a flight to safety. The euro fell sharply from US$1.145 to US$1.100 and depending on political developments in the second week of March, we can see US$1.07-1.13 as the new trading range. The Turkish lira has fallen to the upper level of TRY14.25 in the range of TRY13.25-14.25 with risks to the upside remaining.

Oil and gas

The break-out of war sent oil straight above US$100, reaching US$120. OPEC+ (including Russia) decided not to change its course in the March meeting, despite the USA and other nations releasing extra reserves to curb the rise in prices. Russian oil now trades a discount of 10 per cent to Brent oil, indicating buyers are shying away. As a global commodity, oil will find its buyers, but sanctions may still impact the large Russian export volumes. The TTF gas market exploded upwards based on the fear of cuts from Russian supplies. It reached new all-time highs but a coal rally also supported it.

A high volatility in the oil price can be expected, ranging between US$95 and US$130 potentially.

Coal

Coal prices have more than doubled following the invasion, sending true supply fears through the market. This is based on financial sanctions, but also on freight problems and whether in the short term, it is possible to substitute Russian coal, which accounts for 30 per cent of EU imports.

The API2 and API4 short term contracts have been at an all-time high of US$450, and set out the normal price estimation as this is driven by pure need for the fuel. This in combination with the possibility for industrial buyers to push prices into their end products will determine when we see demand destruction due to buyers closing plants due to power and fossil fuels prices. While alternative fuels will play a considerable part in where these pain levels are, they cannot be supplied in the volumes required to substitute coal and petcoke in the short-term.

In China coal has risen above the NDRC ceiling to US$148 as all global coal types followed API2 and API4 upwards but remained far below world market prices.

In terms of coal contracts, API2 front-quarter (2Q22) increased 150 per cent MoM to US$390. A range of US$220-425 is expected. The API2 front-year Cal23 contract was up 60 per cent MoM to US$190.

The API4 front-quarter (2Q22) contract rose by 145 per cent to US$370. Brannvoll ApS offers a best guestimate range of US$200-400. The API4 new front-year Cal23 contract saw a 55 per cent increase to US$180.

Petcoke

The petcoke market has been totally in the shadow of the events in Ukraine and the massive rallies to all-time highs in the coal market. The estimates of this month’s levels have been carried out via conversations with several sources and analysing historical highs.

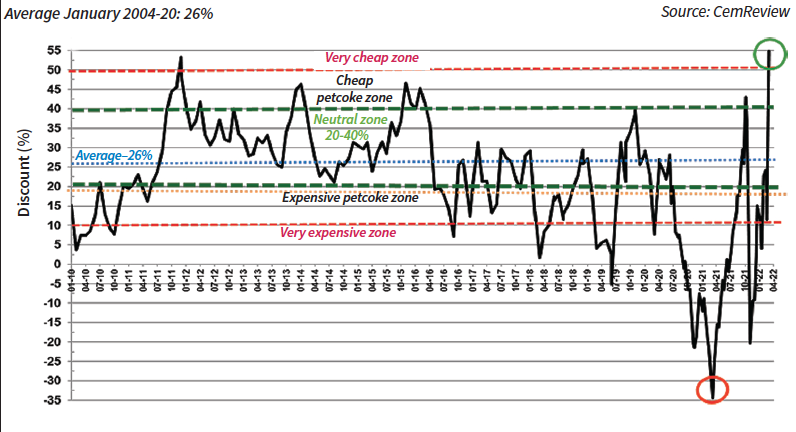

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Mar 2022: -55%

As many petcoke deals are carried out on index, these purchase prices will be far below any realistic spot price, which is very good for these buyers. However, buyers without long-term contracts will be facing considerable price increases. Brannvoll ApS has estimated the petcoke price with discounts rising to the very cheap zone and back to historically high levels. While this sounds like a paradox, it is driven by the coal rally and petcoke prices that are becoming relatively cheaper.

The market has seen very little trading in the first week with spreads of US$40-50.

The USGC FOB 6.5 per cent sulphur contract is estimated to have advanced by 50 per cent MoM to US$190, with the discount to API4 advancing to 59 per cent. USGC CFR ARA 6.5 per cent is up 49.7 per cent to US$220. The discount to API2 increased to 55 per cent from 24 per cent and is near an all-time high.

For 4.5 per cent sulphur petcoke the USGC FOB is estimated to have increased by 48 per cent MoM to US$205 with the discount to API4 at 56 per cent. The CFR ARA contract is estimated at US$220, bringing the discount back up to 49 per cent.

The spread between 4.5 and 6.5 per cent is estimated at US$15 and a range of US$8-18 is expected.