By Frank O. Brannvoll, Brannvoll ApS, Denmark

Energy markets are kept between higher prices due to supply distress, including strikes in refineries for higher wages and the impact of sanctions on Russia. In addition, pressure from inflation rates at 40-year highs is leading to higher lending interest rates and a potential recession. This will lead to lower demand in the cement and other sectors.

The US Federal Reserve increased rates by 0.5 per cent and more hawkish actions are likely in future,while the European Central Bank – with inflation above eight per cent – is poised to act with an expected 125bp increase in 2022. As a result, equity markets have fallen sharply and are putting pressure on property markets.

The euro is stuck in the lower part of the US$1.045-1.12 range.

|

Prices at a glance |

|

| Crude oil - bbl | US$111.50 |

| Coal API2 - 3Q22 | US$353.00 |

| - Cal2023 | US$252.00 |

| Coal API4 - 3Q22 | US$328.00 |

| - Cal2023 | US$231.00 |

| Petcoke - USGC 4.5% 40HGI FOB | US$163.00 |

| CFR ARA |

US$190.00 |

| Petcoke - USGC 6.5% 40HGI FOB | US$177.00 |

| CFR ARA | US$204.00 |

Oil and gas

OPEC+ confirmed its path of increasing crude oil output with 648,000bpd in July-August. However, OPEC+ has not been able to deliver due to disruptions in Libya, sanctions against Russia and strikes.

Iran-US nuclear talks have come to a halt, keeping Iranian production low.

Russia is currently selling oil to non-sanction countries such as China, India and Turkey with large discounts.

China is slowly coming back after COVID-19 restrictions are being lifted, but still fear of a drop in demand has been putting a strong top at US$125.

Brent oil is down from US$121 to US$111. It is expected to trade between US$105-125, and would fall sharply on peace talks in Ukraine.

Coal

Coal driven by API4 has been rising sharply due to increased demand and disrupted trade flows as EU sanctions against Russia and Chinese sanctions against Australia have impacted the market. Russia’s cut in gas supply to the EU has sent gas prices sharply higher, adding to the demand for coal for power generation. Following the EU sanctions that come in force from 10 August, it remains to be seen whether Turkey and other countries will continue to import from Russia with discounts of up to US$150. Meanwhile, Colombia has been increasing exports mostly to the EU.

Moreover, coal is also being challenged by a lack of investment in new production, despite the latest demand growth.

The Chinese market has again expanded to surpass the NRDC proposed maximum.

The API2 front-quarter (3Q22) contract rose 20 per cent MoM to US$53 with a range of US$285-400 expected. The API2 Cal23 contract advanced 10 per cent MoM to US$252. Higher levels are expected to consolidate between US$252-275.

The API4 front-quarter (3Q22) contract rose less than 10 per cent MoM to US$328, with a range of US$280-350 expected. The API4 Cal23 contract was up six per cent MoM to US$231, with an expected range between US$200-250.

Petcoke

Despite apparently large discounts, the petcoke market is falling, pressured by large Russian discounts on coal in Turkey and India, and the lack of buyers for increased supply as cement activity in several markets declines.

Cheap Venezuelan offers to China are also weighing on prices and refiners are seeing lower bids in auctions. In China, domestic coal is still artificially low, while petcoke production is increased as refiners run at 94 per cent capacity. However, strikes in some refineries could change this. The Venezuelan material narrows the gap between high- and medium-sulphur now at US$14.

Sharply-rising discounts are making petcoke attractive when compared to non-Russian coal.

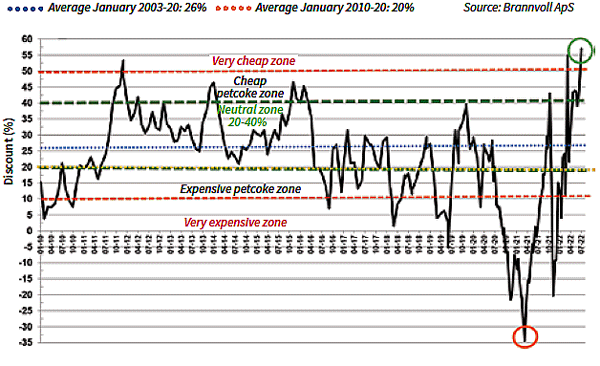

Figure 1: petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jun 2022: 57%

The USGC FOB 6.5 per cent S contract is estimated at US$163, down 9.5 per cent MoM from US$180, with the discount to API4 at 60 per cent, in the very cheap zone. The USGC CFR ARA 6.5 per cent contract fell 11 per cent to US$204 due to lower FOB and freight rates MoM, resulting in an all-time high discount at 57 per cent.

For the 4.5 per cent S petcoke contract, USGC FOB is estimated at US$177, down 8.5 per cent MoM from US$193, with the discount to API4 at 57 per cent. The CFR ARA contract is estimated at US$204 with a discount at 54 per cent.