By Frank O. Brannvoll, Brannvoll ApS, Denmark

Since ICR’s most recent energy report, the energy complex is falling, led by oil, more interest hikes and the fear of recession. Oil prices are down due to lower demand expectations and a small increase in output by OPEC+.

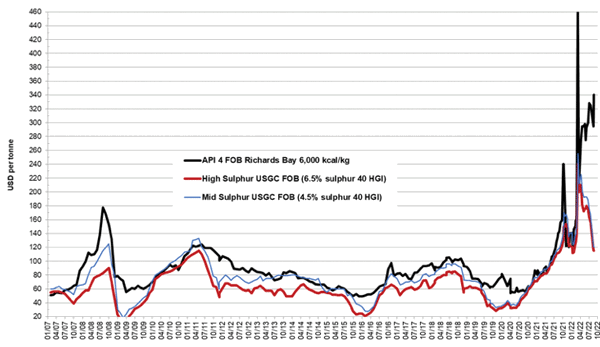

Meanwhile, the price of coal is rising again, driven by higher gas prices. API 4 coal costs now US$340. Russia continues to offer large discounts to non-sanction countries. High-quality coal is in demand in Europe, Colombia, South Africa and Australia.

Steam coal and petcoke FOB prices - historical view 2007-22

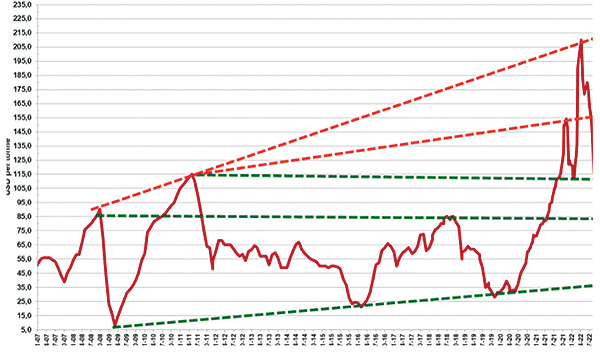

Petcoke prices are dropping sharply despite record discounts as supply is increased and buyers sit back and wait. The high-sulphur (6.5 per cent S) petcoke FOB contract is currently at US$115, with an expected trading range of US$105-130. Resistance is to be found at US$125, 155, 170, 200, 215 and 235, while support is around US$115, 100 and 85. Multi-year support is found at US$36.

High-sulphur petcoke (6.5%) 40HGI FOB USGC - historical view 2007-22

Discounts for high-sulphur petcoke when compared with API4 coal have increased when compared with previous energy report. The discount for 6.5 per cent S petcoke FOB sold at US$115 is at 73 per cent when compared with 4Q22 API4 coal sold at US$340. The CIF ARA 6.5 per cent S petcoke contract sold at US$139.00 is at a discount of 72 per cent, when compared with 4Q22 API2 coal sold at US$390.

Freight rates fell sharply with the USGC-ARA contract at US$24.