By Frank O. Brannvoll, Brannvoll ApS, Denmark

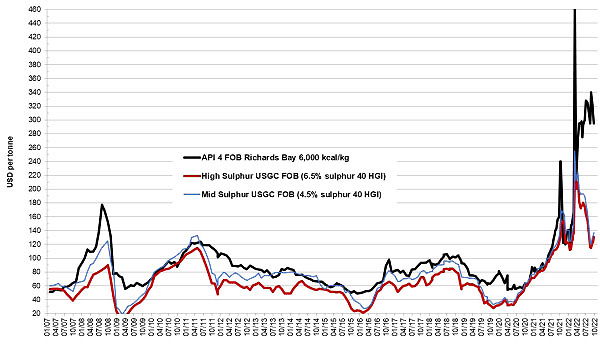

Since ICR’s most recent energy report, the energy markets are fearing an upcoming recession due to higher rates to curb inflation. Oil has fallen below US$90 despite OPEC+ decreasing output. Moreover, coal prices are also dropping despite European demand. API4 is currently at US$295. Meanwhile, Russia is offering large discounts, but the market continues to be driven by recession fears.

Steam coal & petcoke prices FOB

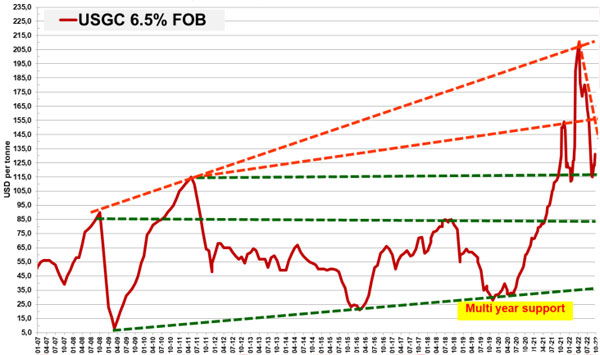

Petcoke prices have stopped their downward trend with huge discounts now attracting sellers from India and China. The high-sulphur (6.5 per cent S) petcoke FOB contract is currently at US$131, with an expected trading range of US$115-145. Resistance is to be found at US$140, 155, 170, 200, 215 and 235, while support is around US$125, 115, 100 and 85. Multi-year support is found at US$36.

High-sulphur petcoke (6.5%) 40HGI FOB USGC

- historical view 2007-22

Discounts for high-sulphur petcoke when compared with API4 coal have increased when compared with previous energy report. The discount for 6.5 per cent S petcoke FOB sold at US$131 is at 64 per cent when compared with 4Q22 API4 coal sold at US$295. The CIF ARA 6.5 per cent S petcoke contract sold at US$154.00 is at a discount of 58 per cent, when compared with 4Q22 API2 coal sold at US$292.

Freight rates stabilised with the USGC-ARA contract at US$23.