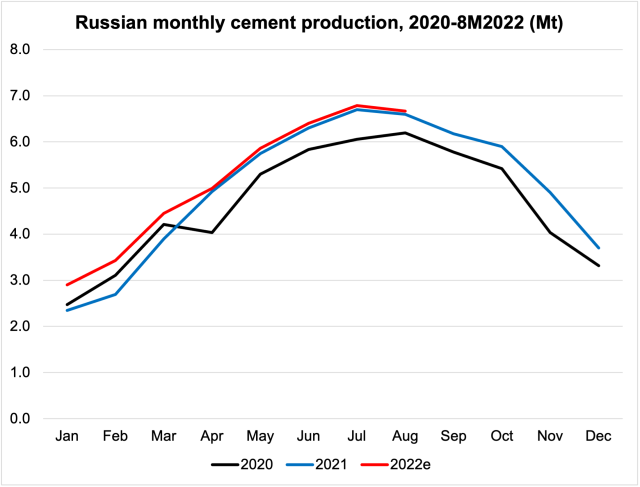

Despite the ongoing conflict in Ukraine, and unprecedented sanctions imposed on Russia, the Russian cement industry is withstanding the crisis with volumes continuing to expand so far this year. According to data from SOYUZCEMENT, cement consumption in Russia in January-August 2022 reached 41.8Mt, up 5.6 per cent YoY. Cement production over the same period advanced by six per cent to 41.1Mt, although August did report a 1.7 per cent drop in output, compared to the previous month.

Russian monthly production in 2022 continues to exceed year ago volumes

In terms of trade, the 8M22 saw cement imports to Russia fall by 4.4 per cent YoY to 1.24Mt, while exports declined by 24.6 per cent YoY to 679,600t. The biggest growth in exports was seen to Abkhazia, part of Georgia (+395 per cent), and Azerbaijan (+34 per cent), while the biggest falls were seen to Finland (-80 per cent), Belarus (-49 per cent) and Kazakhstan (-17 per cent).

The economic consequences arising from the military conflict have in part been mitigated by rising energy prices. The International Monetary Fund (IMF) has upgraded its forecast for Russia's economy in 2022 and now expects it to contract 3.4 per cent instead of the 8.5 per cent projected in April.

Volumes of domestic housing construction have also seen positive dynamics so far in 2022. Data from the Russian Federal State Statistics Service (Rosstat) show that in January-August this year, the volume of housing construction came in at 69.6Mm2, up 33.3 per cent on the same period in 2021. While September this year saw the figures fall by eight per cent to 9.4Mm2, analysts do not expect that trend to continue into the fourth quarter of 2022, with the housing market forecast to be a key driver of cement demand growth going forward.

Infrastructure construction will be another growth area going into the 4Q22 with cement demand supported by state plans to conduct massive cement procurements to enable the restoration of former Ukrainian cities, which are currently under Russian control. According to analysts, this growth should provide the Russian cement industry with an opportunity to offset some of its losses.

A recent report by the Russian analyst agency in the field of construction materials, SMPRO, found that despite the stable demand for cement and increasing production volumes, cement producers are still facing significant losses. Overall cement capacity in Russia is an estimated 103Mta but utilisation rates in the Russian cement sector are relatively low at around 50 per cent. According to Vladimir Guz, managing partner of SMPRO, the unprofitability of Russia’s cement businesses is due to the failure of domestic cement prices to keep up with production costs.

Gennady Rasskazov, vice president of Sibcem, one of Russia’s leading cement producers, believes that the overall production cost of cement in Russia will rise by 30 per cent in 2022 due to an increase in the cost of diesel fuel, coal, oils, lubricants, etc. The average natural gas price in the country stands at RUB6759/1000m3 (US$110.46/1000m3), approximately 10 per cent higher than this time last year. The situation is further complicated by a significant increase in the cost of equipment repairs. According to Mr Guz, repairs and the replacement of components is becoming increasingly expensive, due to their dependence on the price of ferrous metallurgy products.

Producers continue to face a number of challenges, including overproduction and excessive concentration in some of the historical centres of cement production, such as the north-west region and the Volga region. The low level of utilisation rates is also inflating production costs, alongside soaring prices of gas and electricity. One final obstacle is the growing trend among developers in the construction industry to use various additives as alternatives to cement to help lower their construction costs.

Looking ahead, cement production in Russia is forecast to expand to an estimated 62Mt in 2022, up from 61Mt in 2021 and 56Mt in 2020. Production is then expected to slip to 57Mt in 2023, according to industry analysts, assuming a downside scenario where continued sanctions adversely impact the internal economy.