By Frank O. Brannvoll, Brannvoll ApS, Denmark

Since ICR’s most recent energy report, coal prices are rising due to supply disruptions and a colder winter in Europe. Russian discounts are still in place but reflect the rising costs of Russian producers. Oil is falling on fears of a new Chinese lockdown and demand destruction in the EU leading to lower growth.

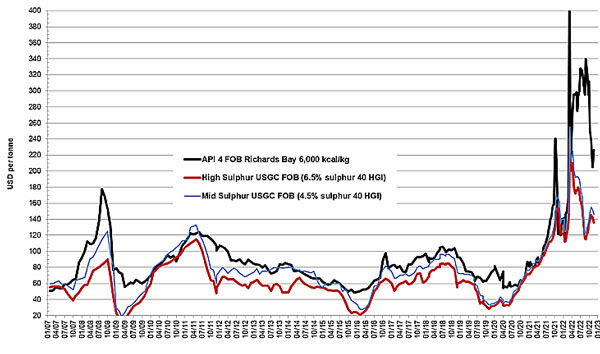

Steam coal and petcoke prices FOB

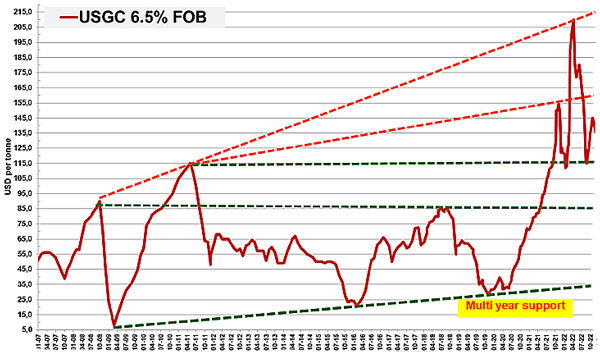

Petcoke prices are stable as buyers from China and India are on hold, and discounts have fallen since the highs in autumn. The high-sulphur (6.5 per cent S) petcoke FOB contract is currently at US$136, with an expected trading range of US$125-150. Resistance is to be found at US$155, 180 and 215, while support is around US$125, 115, 100 and 85. Multi-year support is found at US$36.

High-sulphur petcoke (6.5%) 40HGI FOB USGC -

historical view 2007-22

The discount for 6.5 per cent S petcoke FOB sold at US$136 is at 52 per cent when compared with 4Q22 API4 coal sold at US$226. The CIF ARA 6.5 per cent S petcoke contract sold at US$1159.50 is at a discount of 46 per cent, when compared with 4Q22 API2 coal sold at US$237.

Freight rates stabilised with the USGC-ARA contract at US$23.5.