By Frank O. Brannvoll, Brannvoll Aps, Denmark

Petcoke rallied in August, driven by a lack of supply and higher coal prices led to stable discounts in the neutral zone. Petcoke with 6.5 per cent S is expected to continue in the US$90-105 range with resistance at US$95, US$105, US$115 and US$135. Support is at US$90, US$85, US$70, US$68 and US$55.The 4.5 per cent S petcoke contract is now well above US$100 as previously warned.

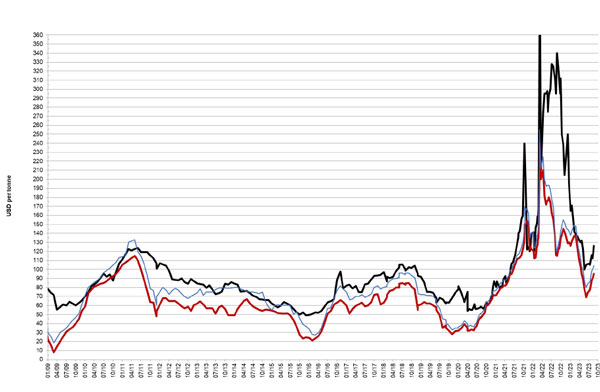

Steam coal and petcoke FOB prices, 2009-23 – API4 FOB Richards Bay 6000kcal/kg coal (black), 6.5% sulphur 40 HGI

USGC FOB petcoke (red) and 4.5% sulphur 40 HGI USGC FOB petcoke (blue)

The discount for 6.5 per cent S petcoke FOB sold at US$95 is at 40 per cent when compared with API4 coal sold at US$126 in the 4Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$115 is at a discount of 30 per cent, when compared with API2 coal sold at US$127.50 in the 4Q23.

Freight rates are stable with the USGC-ARA rate at US$16.50.