By Frank O. Brannvoll, Brannvoll Aps, Denmark

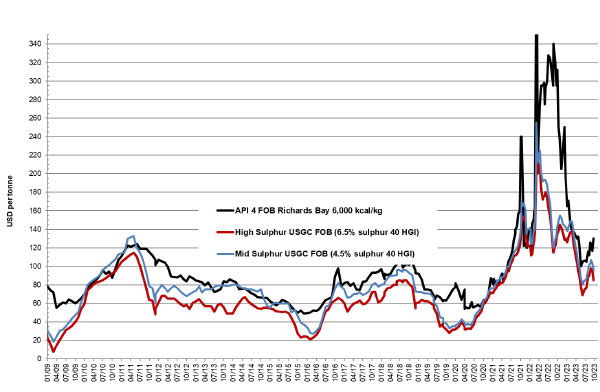

Coal has continued its recovery with a higher energy complex, consolidating in the US$110-140 range and balancing Russian supply.

Petcoke saw a sharp fall on increased supply, leading to a switch to coal as the discount fell to low levels. Both grades are now below US$100 and pushed down by freight. The increased FOB discount is expected to lure in new buyers.

Petcoke with 6.5 per cent S is expected to continue in the US$80-95 range with resistance at US$98, US$105, US$115 and US$135. Support is at US$85, US$70, US$68 and US$55.

The discount for 6.5% S petcoke FOB sold at US$85 is currently at 48 per cent

when compared with API4 coal sold at US$130 in the 4Q23

The discount for 6.5 per cent S petcoke FOB sold at US$85 is at 48 per cent when compared with API4 coal sold at US$130 in the 4Q23. The CIF ARA 6.5 per cent S petcoke contract sold at US$107 is at a discount of 30 per cent, when compared with API2 coal sold at US$122 in the 4Q23.

Freight rates are increasing with the USGC-ARA rate at US$22.