By Frank O. Brannvoll, Brannvoll ApS, Denmark

A geopolitics crisis emerged with the Hamas attack on Israel at the beginning of October.

The European Central Bank raised interest rates 0.25 per cent but is behind the US Federal Reserve (Fed). This has strengthened the US dollar as the Fed still talks of keeping rates high for longer. The two per cent inflation target is still far away. In October the fear surrounding China’s property market re-emerged and, along with higher interest rates, increased the risk of a recession. As a result, fear of lower demand impacted the energy complex, led by speculators in oil.

As European states and US Republicans start to question the war in Ukraine, Ukraine may look for the best deal if full support is present, as the US election campaign will soon start for real. Russian elections in March 2024 could be the opportunity.

The dollar index looks toppish and has weakened commodities. The euro-US dollar exchange is seen in the lower range of US$1.04-1.08 in the short-term. Brannvoll ApS forecasts a range of US$0.95-1.15, with an average of US$1.07 in 2023.

| Prices at a glance | ||

| Brent crude oil (bbl) | US$87.00 | |

| Coal API2 |

4Q23 | US$118.00 |

| Cal 2024 |

US$119.00 | |

| Coal API4 |

4Q23 | US$120.00 |

| Cal 2024 |

US$124.00 | |

| Petcoke USGC |

4.5% 40HGI FOB |

US$92.00 |

| 4.5% CFR ARA |

US$113.00 | |

| 6.5% 40HGI FOB | US$84.00 | |

| 6.5% CFR ARA | US$105.00 | |

Oil and natural gas

Russia and Saudi Arabia prolonged their production cuts of 1.3mb/d to the end of 2023, and OPEC+ confirmed the overall cuts to the end of 2024. Oil dropped after an EIA report of US gasoline stocks, starting a speculative sell-off from financial investors. This led to a 13 per cent drop from US$97 to US$84. This may lead to a test of OPEC+ willingness to potentially cut even more to support the US$80-90 range.

The eruption of war between Hamas and Israel adds an element of short-term uncertainty to the oil markets with the risk that Iran could start a blockade or even military action in the Strait of Hormuz. As a result, the price of oil increased by four per cent.

The market is approaching a deficit but only because OPEC+ has cut 2.5mb/d. However, new supply is expected from Venezuela and Iraq, and a higher WTI price will start up US production.

The topside remains supported by an upcoming deficit in the 1Q24. Brent oil fell seven per cent to US$84 within its new range of US$82-95.

Brannvoll ApS forecasts a trading range US$75-110/bbl, with an average of US$88/bbl for the rest of 2023.

In terms of the gas market, TTF front-month remained at EUR36/MWh and the Cal24 contract fell 12 per cent to EUR46/MWh.

Coal

Coal prices moved slightly lower, pressured by oil and gas. Russian coal has been offered on discounts to countries outside the sanctions but will now see a 4-7 per cent export fee, with the exact level inversely proportionate to the strength of the Russian rouble vs the US dollar, according to exporters.

In Colombia a court has annulled the presidential decree that forbids coal sector expansion, which is expected to lead to higher Colombian exports. In Indonesia coal exports are also set to increase.

The API2 front-quarter (FQ) contract rose by two per cent MoM to US$118, maintaining a short-term range of US$110-125. The API2 Cal24 contract fell two per cent MoM to US$119. For 2023 Brannvoll ApS forecasts a range of US$100-220 with an average of US$150 for quarterly and calendar year API2 contracts.

The API4 FQ contract increased by three per cent MoM to US$120, resulting in a higher short-term range of US$110-125. The API4 Cal24 contract was up six per cent MoM to US$124. Brannvoll ApS forecasts a range US$100-220 with an average of US$150 in 2023.

Petcoke

Petcoke had fallen sharply to US$80 but started to go higher as discounts lured buyers from India, and Chinese buyers asked for offers. Most traders have sold inventory material. The potential hurricane season will cause some upticks in the 4Q23. Venezuela has again been exporting to Turkey. If Russian coal drives through a new export duty, it may increase the demand for petcoke. In the US lower river water levels have limited the supply to the USGC in recent weeks, supporting prices.

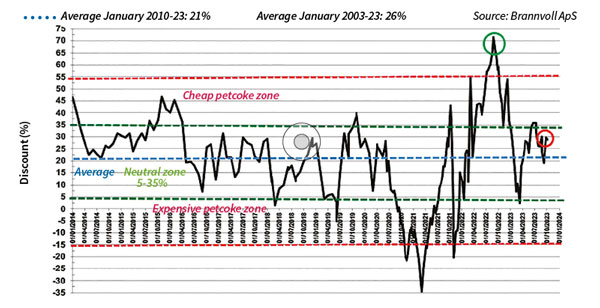

petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jul 2023: 29%

The USGC FOB 6.5 per cent sulphur (S) contract fell 12 per cent MoM to US$84, with the discount to API4 risen to 44 per cent. The USGC ARA 6.5 per cent S contract was down by 12 per cent MoM to US$105 and discount risen 29 per cent. Freight began to fall at the start October supporting FOB rates.

The USGC FOB 4.5 per cent S contract is down 12 per cent MoM at US$92, with the discount to API4 up to at 39 per cent. The CFR ARA 4.5 per cent contract fell by 10 per cent MoM to US$113 with the discount at 25 per cent.