By Frank O. Brannvoll, Brannvoll ApS, Denmark

The Israel-Gaza situation seems to be contained from spreading and the war premium has quickly faded as no disruptions in any markets have been seen. The focus has now shifted back to demand and supply.

The two major central banks kept their rates unchanged in the October meetings, keeping to the “higher for longer” rhetoric with inflation still too high for both the US and EU central banks. China’s growth, particularly in the property market, still triggers the next direction of the energy complex as the Chinese slowdown has reduced marginal oil demand considerably.

In October the IMF updated its 2024 GDP growth forecasts, reducing world GDP growth to 2.9 from three per cent and increasing the euro area indicator to 1.2 from 0.7 per cent. Downside risks include higher interest rates and the Russia-Ukraine war. The Russia-Ukrainian war is increasingly being questioned in the media, which could lead to a push for negotiations. A negotiated peace would impact positively on the markets.

The euro-US dollar kept its range US$1.05 -1.09 after having tested US$1.05. Brannvoll ApS forecasts a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance – as at 6 November 2023 |

||

|

Crude oil (US$/bbl) |

84.00 |

|

|

Coal |

API2 – 1Q24 (US$) |

112.00 |

|

API2 – Cal 2024 (US$) |

114.00 |

|

|

API4 – 1Q24 (US$) |

119.00 |

|

|

API4 – Cal 2024 (US$) |

121.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

102.00 |

|

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

124.50 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

94.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

116.50 |

Oil and natural gas

The war premium faded away as the Gaza war has been contained for now and the markets have focussed on demand. The retracement to around US$85 has led to Russia and Saudi Arabia maintaining their 1.3mb/d production cuts until the end of 2023. Traders have focussed on fears of fading Chinese demand, despite the IEA warning of upcoming deficits in the market, currently artificially created by OPEC+. The US has lifted the sanctions on Venezuela, which will soon add more supply to the markets.

Brent oil remained unchanged at US$84.00 but has been near US$90 with a near-term range of US$82-90.

Looking ahead, market analysts are wildly divided between US$120 as a deficit will emerge to below US$65 due to recession in 2024. Brannvoll ApS forecasts a trading range US$80-110/bbl, with an average of US$95/bbl for 2024.

In the gas market, the TTF Cal24 contract remained in the range EUR46-50/MWh.

Coal

Coal prices retraced with oil and a lower Chinese domestic price. Chinese imports were also lower due to higher domestic production and higher hydro and renewable generation, exerting pressure on the international market. Russian prices have been meeting competition as markets went lower. ARA stocks see their lowest levels for the year but on average for the previous years. Russian exports may be hit by the new export taxes depending on the ruble value (now at RUB99), adding seven per cent tax.

The API2 front-quarter (FQ) contract fell by five per cent MoM to US$112, maintaining a short-term range of US$110-125. The API2 Cal24 contract fell again by two per cent MoM to US$116. Back to “almost” normal. For 2024 Brannvoll ApS forecasts a range of US$100-135 and an average of US$125 for both 1Q24 and Cal24 contracts with the Cal24 ranging US$100-130.

The API4 FQ contract fell just one per cent MoM to US$119, remaining in short-term range of US$110-125. The API4 Cal24 contract was down two per cent MoM to US$121. Brannvoll ApS expects a range of US$100-150 in 2024 as volatility is higher.

Petcoke

Petcoke continued its rally as companies wanted to secure 1Q24 loads and coal prices had been higher, with discounts high. Following a drop in the coal price, petcoke has returned in the lower end of the discount. It could face resistance at the levels where the 4.5 per cent is back above US$100.

The lifting of the sanctions on Venezuela will send more supply to markets that did not wish to buy due to the sanctions. China also appears to be interested in discounted Venezuelan petcoke as its total petcoke stock has fallen sharply to ~1Mt. For 2024 the USGC is expected to produce and export more material.

Mexico’s Pemex new refinery is also going into production in the 1Q24, lowering demand from Mexico. In Turkey the competition is still against Russian coal, but here Venezuelan product may also return.

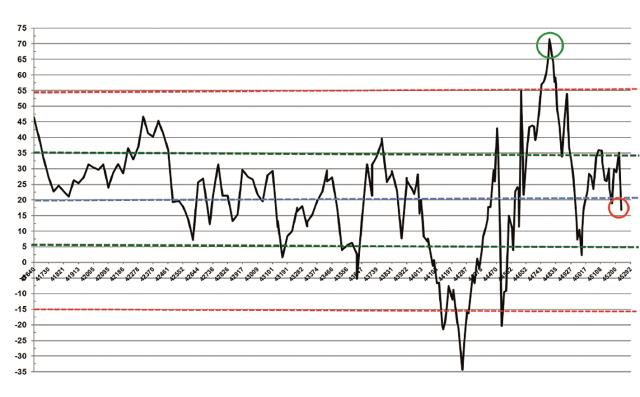

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Nov 2023: 17%

The USGC FOB 6.5 per cent sulphur (S) contract rose 12 per cent MoM to US$94 while the discount to API4 fell to 37 per cent. The USGC ARA 6.5 per cent S contract was up by 11 per cent MoM to US$116.5 and discount down to 17 per cent.

The USGC FOB 4.5 per cent S contract is up 11 per cent MoM at US$102, with the discount to API4 down to 31 per cent. The CFR ARA 4.5 per cent contract rose by 10 per cent MoM to US$122.5 with the discount at a low 11 per cent.