By Frank O. Brannvoll, Brannvoll ApS, Denmark

The energy complex fell further in December but recovered by the end of 2023.

In geopolitical terms, the Israel-Gaza conflict has seen increased risk of spreading and ship attacks in the Red Sea from Houthi terrorists in Yemen increased risk for oil and good shipping. A western UN-backed naval force has put an ultimatum and when attacks stop this would take some support away. The Ukraine-Russia war remains largely frozen, but hints of some movement behind the scenes and exchange of prisoners could lead to potential talks in the run-up to the upcoming Russian elections.

Based on Federal Reserve speeches, the markets became convinced US interest rates would come down very fast, however this has now changed to the Fed keeping rates higher, supporting the US dollar. The European Central Bank also kept rates unchanged in December. Meanwhile, the Turkish central bank raised rates to 42.5 per cent to fight inflation.

The euro-US dollar is stable at US$1.0950 down from US$1.11 and remains in the range of US$1.06-1.10. Brannvoll ApS maintains a range of US$1.00-1.15, with an average of US$1.10 in 2024.

|

Table 1: Prices at a glance - 4 January 2024 |

||

|

Crude oil (US$/bbl) |

77.00 |

|

|

Coal |

API2 – 1Q24 (US$) |

107.00 |

|

API2 – Cal 2025 (US$) |

97.00 |

|

|

API4 – 1Q24 (US$) |

99.00 |

|

|

API4 – Cal 2025 (US$) |

98.00 |

|

|

Petcoke |

USGC 4.5% 40 HGI – FOB (US$) |

65.00 |

|

USGC 4.5% 40 HGI – CFR ARA (US$) |

92.00 |

|

|

USGC 6.5% 40 HGI – FOB (US$) |

60.00 |

|

|

USGC 6.5% 40 HGI – CFR ARA (US$) |

87.00 |

|

Oil

Geopolitics, as outlined above, provided short-term support, driving oil towards US$80/bbl, but fear of lower demand due to higher US rates and looming inflation sent the Brent price lower.

The war threat in South America has vanished for now, with a focus returning to oil supply-demand. From January 2024 Brazil has joined OPEC. The IEA has warned of slower demand growth, but oil still saw an all-time high in 2023.

Speculators are still shorting oil on the belief that output outside OPEC will increase 1mb/d in 2024 and put pressure on the market.

For now, the short-term range is set at US$75-85. Brannvoll ApS lowers the forecasts to a trading range of US$75-105, with an average of US$90 for 2024.

Coal

No big news in the coal market, but prices again retraced with oil and lower Chinese domestic prices. ARA stocks are high and EU imports are at a decade low. A cold winter snap could give short-term support as prices are around big support levels.

China has introduced a new import tariff, currently at six per cent, to countries that do not have a free trade agreement with China.This will not impact Australia and Indonesia but Russian, US and South African coal will be subjected to the tariff.

The API2 front-quarter (FQ) contract fell by three per cent MoM to US$107, lowering the short-term range of US$100-120. The new front Cal API2, Cal25, slipped 15 per cent MoM to US$97. Brannvoll ApS forecasts a range of US$100-135 and an average of US$125 for both 1Q24 and Cal25 contracts with the Cal25 ranging between US$100-130.

The API4 FQ contract fell again nine per cent MoM to US$99, lowering the short-term range of US$95-115. The API4 new front Cal25 contract fell 11 per cent MoM to US$98. Brannvoll ApS expects a range of US$100-150 in 2024 as volatility is higher in API4.

Petcoke

Petcoke trade was scarce in December and buyers stepped back due to high freight rates. Chinese and Indian domestic prices fell, lowering import demands. In Turkey, petcoke fell further and severely competed with Russian coal.

The petcoke price was pressured by coal and now offers major discounts. Venezuela is forcefully pushing its medium-term material to India, China and Turkey, also lowering the spread to 6.5 per cent.

The upcoming quarter is seen as Indian cement buyers’ best season and if freight rates fall, the lower prices could turn the market quickly as seen before. However, in the short-term another five per cent drop in prices could be seen.

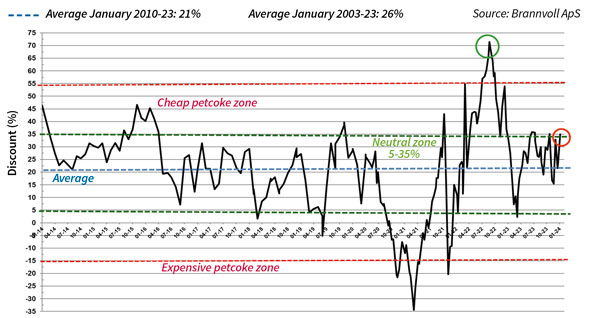

Petcoke discount to coal – API2 USGC 6.5% USGC ARA based on 6000kcal: Jan 2024: 35%

The USGC FOB 6.5 per cent sulphur (S) contract fell by eight per cent MoM to US$60, while the discount to API4 remained flat at 51 per cent. The USGC ARA 6.5 per cent S contract was down nine per cent MoM to US$87 and the discount up to 35 per cent, taking it to the cheap zone.

The USGC FOB 4.5 per cent S contract fell 10 per cent MoM at US$65, with the discount to API4 up to 48 per cent. The CFR ARA 4.5 per cent contract fell by 10 per cent MoM to US$92, going below US$100 for first time since May with the discount increasing to 31 per cent.

At these levels petcoke is still in the cheap zone, which is often short-lived. With coal below US$100 also believed to a support level that could reverse, and petcoke at the current level is seen as a buying opportunity.